2011 – 2014 Hiring Trends Report

Trends in the private equity and venture capital industry are following expected patterns, with a shift away from the United States towards Europe and Asia. Back in 2013, David Rubenstein, co-founder of the Carlyle Group, pointed out that the United States was unlikely to continue retaining the majority of the market.

“If the U.S. accounts for 20% of the world economy, how does it account for 100% of the world’s largest private equity firms?” Rubenstein asked. He predicted that the competition would arise from other economies in the future –emerging economies were especially promising candidates.

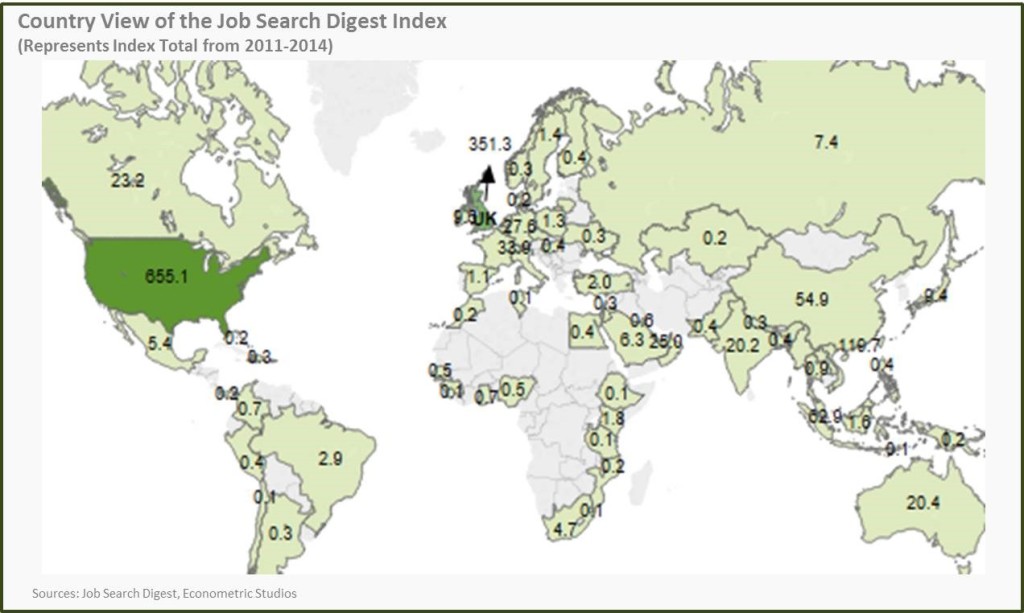

Accordingly, Job Search Digest has found that the financial industry has been setting up shop in key European and Asian cities. Surprisingly, some very large and economically important countries have relatively few financial sector job postings, including Russia, Japan, France, Spain, Brazil, and Argentina.

Job Search Digest’s data provides an interesting insight into financial market trends through the state of financial sector employment, by tracking employment opportunities in a comprehensive database with over a decade of jobs data. In contrast with other job reports, which study sector-level detail and other broad measures of the labor market, Job Search Digest provides a timely look at detailed aspects of employment and job openings in private equity and venture capital.

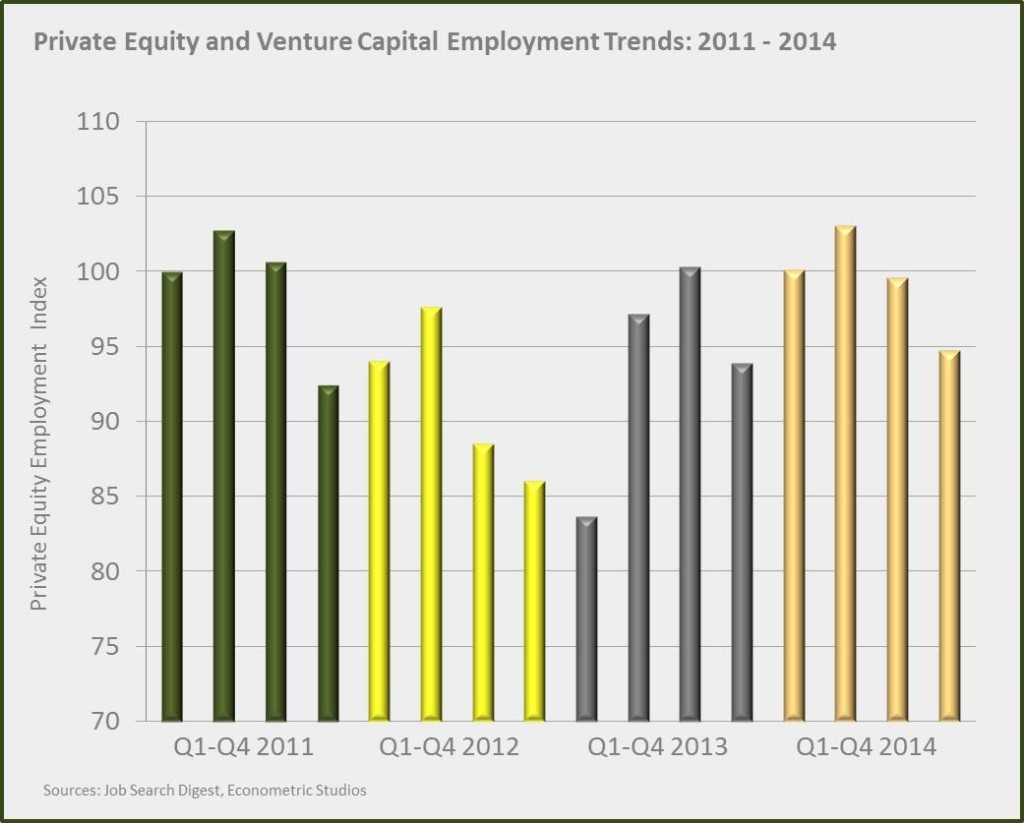

The private equity and venture capital industry is recovering from the global financial crisis. Although the industry started off with relatively strong hiring in 2011, employment conditions weakened significantly from early 2011 to the first quarter of 2013.

“The global private equity sector has seen a significant downturn in activity since the start of the economic crisis, which is concerning because it is an important source of funds for the growth businesses that are needed to bring economic recovery,”commented Chris Cummings, Chief Executive of financial industry organization TheCityUK, in July 2012.

Conditions improved markedly after bottoming in early 2013. Job Search Digest’s Employment Index, which is set to 100 in Q1 2011, captures these movements in the job market.

After a peak of 103 in the second quarter of 2014, conditions weakened somewhat to 95 at the end of 2014 but this cyclical movement was to be expected.

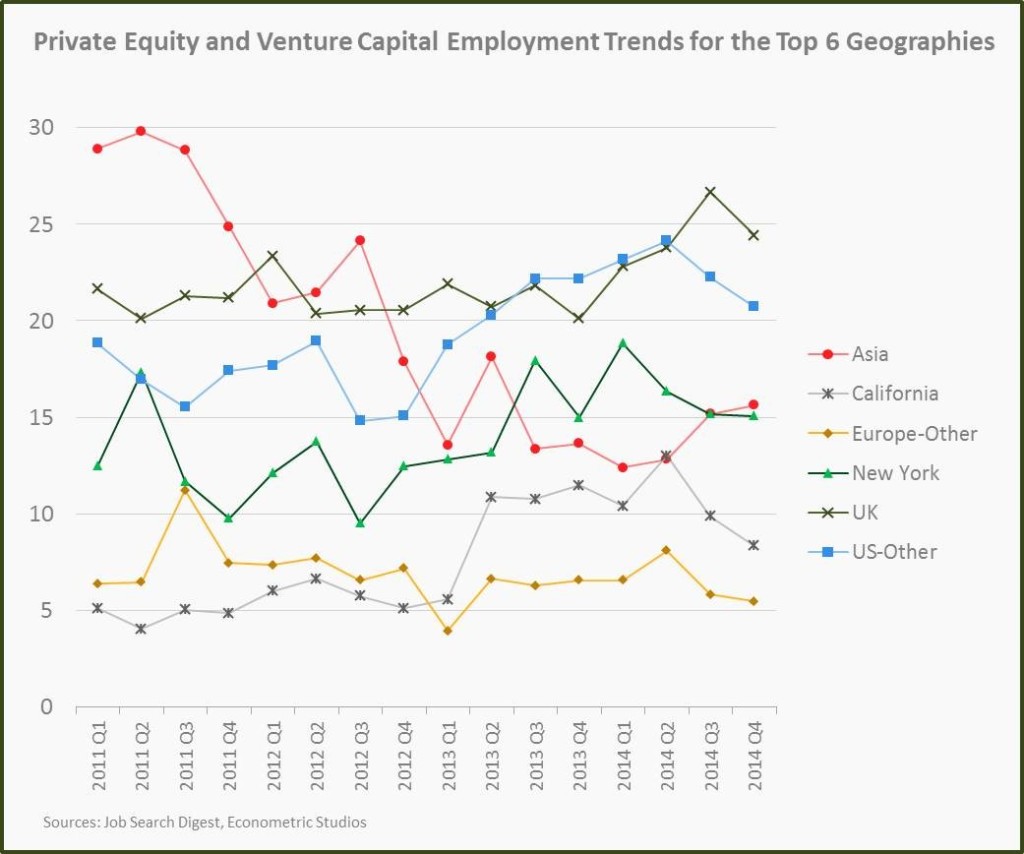

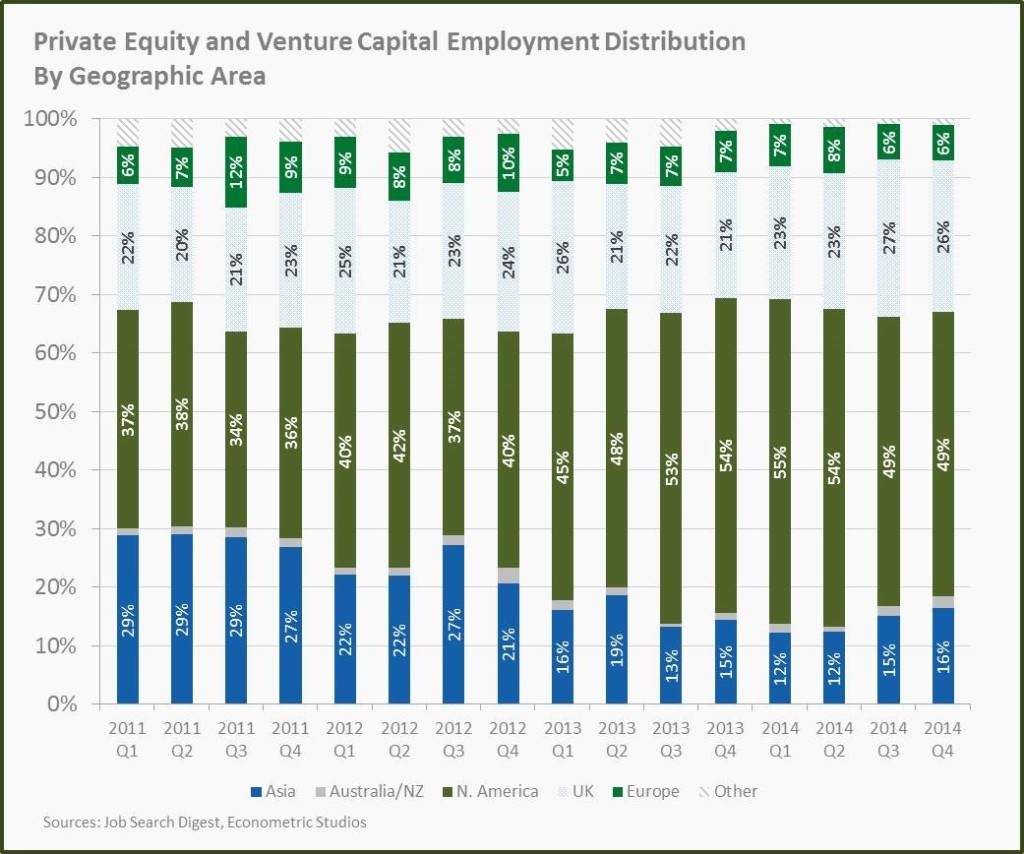

Similar to market hiring trends, global employment distributions are reverting back to pre-financial crisis levels. Asia in particular has become “a ‘hot’ destination for international investors that strive to diversify their portfolios through new profitable ventures”. A recent study has found that Asia has the fastest regional growth for private equity.

In 2011, job postings in Asia reflected a Job Search Digest Index of 29 for private equity and venture capital jobs in the world, which represented a market share of only 8 points less than that of the United States. After a fairly severe ride through the crisis, new job postings in Asia only accounted for an Index of 16 at the end of 2014 – as opposed to the Indices of 44 and 24 of the United States and the United Kingdom, respectively.

Job Search Digest’s database captures detailed changes in global employment distributions. The top place for job openings in the financial world is currently the United Kingdom, with a Job Search Digest Index of 27 at the end of 2014.

New York remains the largest private equity center by funds raised, but London is rapidly gaining ground as the second largest center. This shift reflects the overall view among many that London is becoming the financial capital of the world, taking the lead from the U.S., following the recovery from the global financial crisis.

“The private equity landscape is constantly evolving and fundraising is on the rise in the US, with New York the strongest city globally for raising capital. London is a powerhouse in its own right, whilst second to New York, there is no European city close to matching London’s ability to raise private equity capital,” said Dan Gunner, head of research at Private Equity International.

It remains to be seen whether London can maintain its two consecutive quarter top spot for job openings in the industry. In contrast, New York currently holds the fourth highest spot in the job openings rankings. Also of interest are the European Union results; outside of the UK, job prospects in private equity and venture capital in Europe are relatively low.

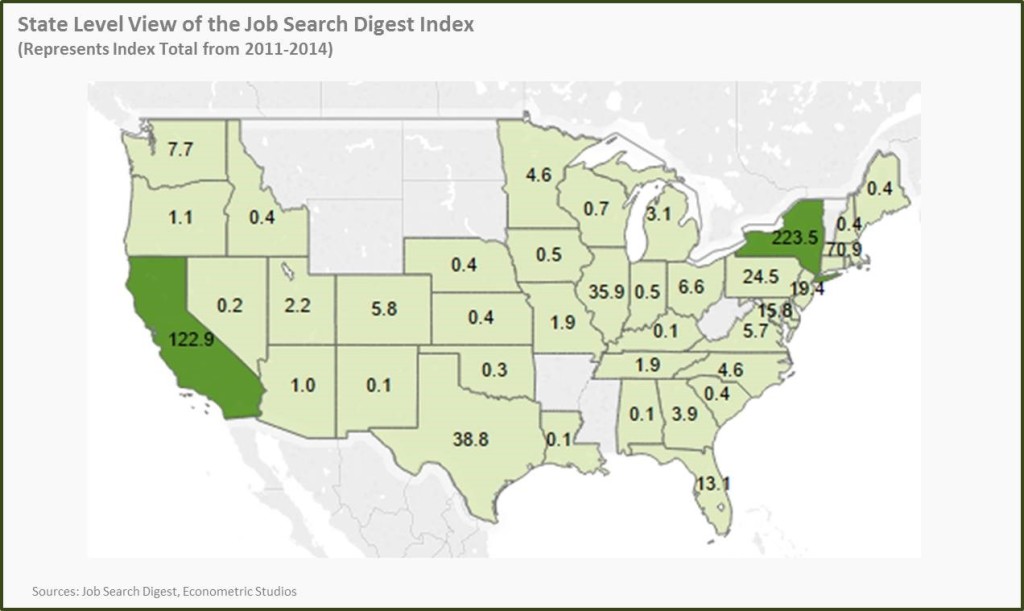

Despite the decrease in opportunities available in New York, North America collectively has not yet been outstripped by Europe. The northeastern United States is a pacesetter in the financial sector, with New York City as the most important hub (see the latest job openings in NY). However, the United States has other important centers for private equity and venture capital, including Massachusetts, Connecticut, New Jersey, Pennsylvania, Florida, and Washington, D.C., on the east coast. Non-eastern U.S. states with important ties to the financial industry include Illinois, Texas, and California.

A larger geographical view of private equity and venture capital employment distribution shows that North America accounted for 49% of all industry job postings at the end of 2014. The United States is a safer market for the time being; Bain & Company’s 2015 Global Private Equity Report finds that “[i]n striking contrast to trends elsewhere, macroeconomic signals are flashing green across North America”.

The larger groups make the fall of Asian job opening share more apparent; Asia fell from 29% in 2011 to a low of 12% in the first and second quarters of 2014. That figure is on the rise again, however, ending at 16% in 2014.

A recent 2015 study by Bain & Company notes, “Private equity (PE) in the vibrant Asia-Pacific region finally began to reward investor patience in 2014 as the market broke out of a sobering two-year slump and posted its best across-the-board performance to date…a number of important developments over the past year signal the market may be reaching a critical turning point.”

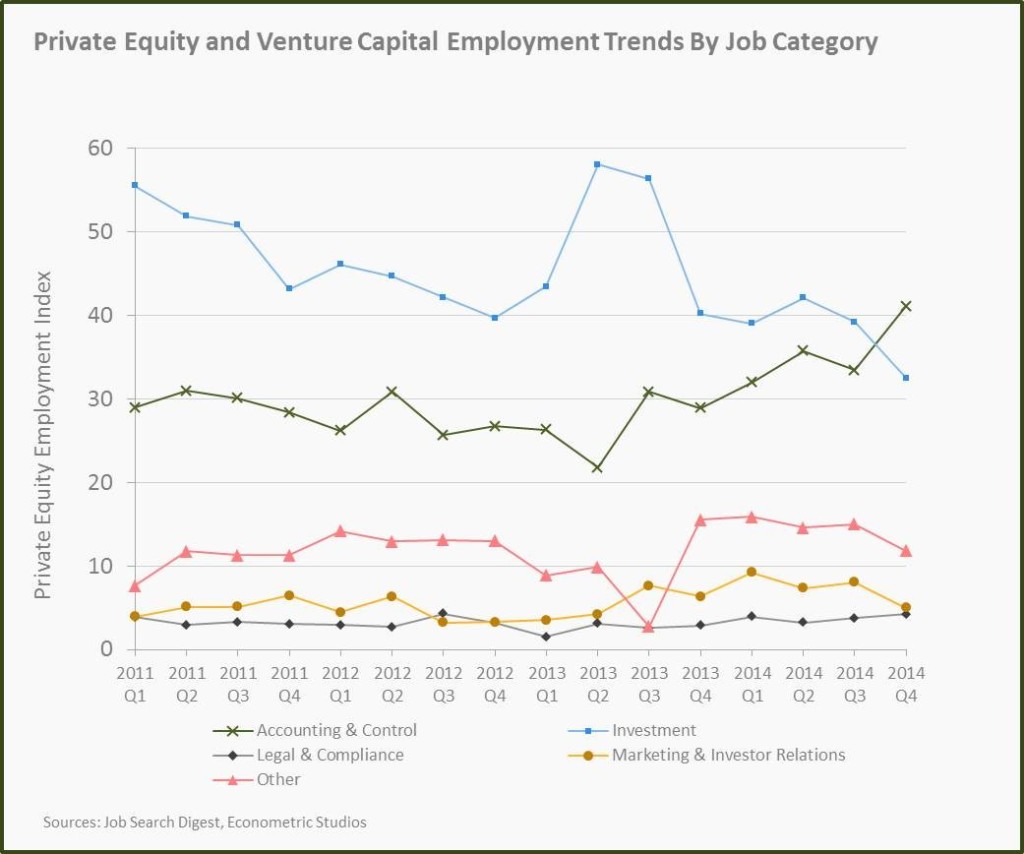

Given all this data on broad geographical markets trends, the next question for industry professions is – what kind of jobs are hiring?

Historically, “Investment” jobs have had the strongest hiring performance, with “Accounting and Control” jobs coming in second. In 2014, the two categories performed a large role reversal. “Accounting and Control” is now on a strong upward trajectory as the largest category, almost doubling in job openings since the second quarter of 2013. Growth accelerated in the latter half of 2014. In comparison, “Investment” is on a moderate downward trajectory.

The rise of accountants is a well-known trend, but its dominance over investment is perplexing. Staffing firm Robert Half released an analysis report that stated, “Business leaders desire professionals who can delve into the numbers and explain their implications for top-line growth trends and possible merger and acquisition activity.”

This explanation could apply to any number of industry jobs, but the remaining categories also seem to be on a downward trend. Also interesting is the jump in Marketing and Investor Relations in the third quarter of 2013. This may have been caused by changes introduced by the U.S. JOBS Act, which lessened restrictions on advertising in search for investable capital.

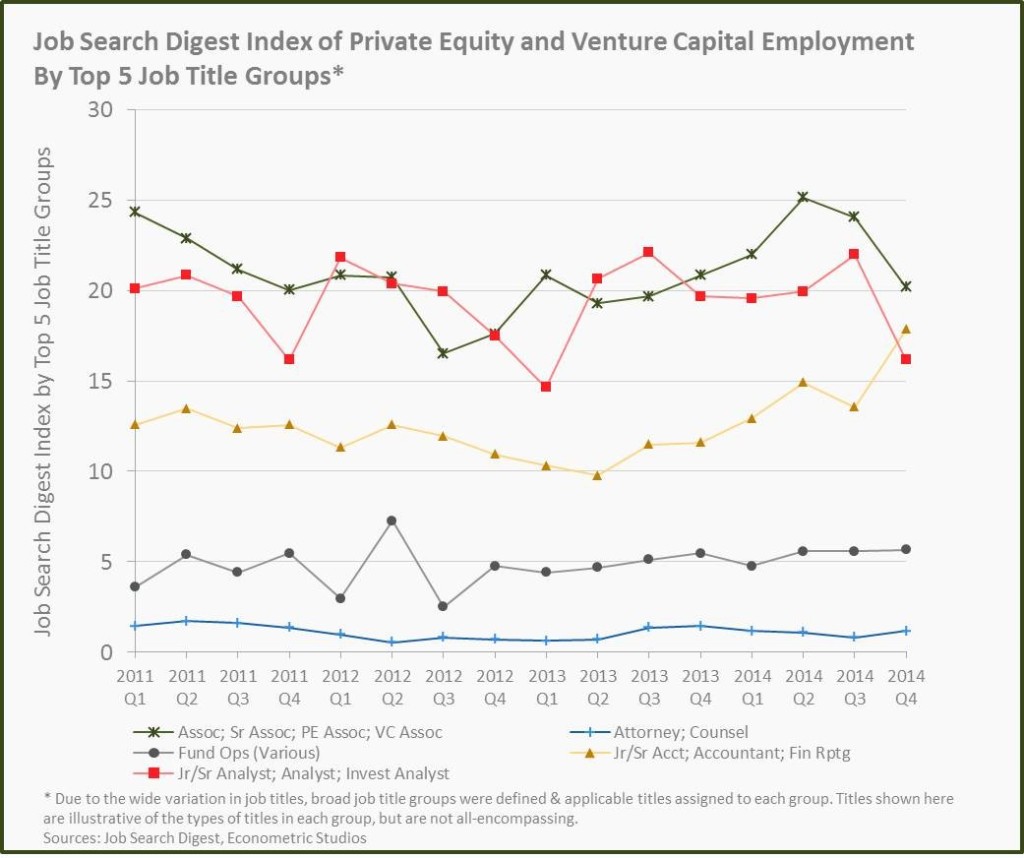

Strong trends in accounting are also reflected in job title analysis. Given the vast array of job titles investment firms offer employees, it’s impossible to make decipherable all the “title trends” for every single job listing. Instead, Job Search Digest has categorized similar titles into broad groups.

Unsurprisingly, the most commonly posted job titles for most of 2014 were “Associates” and “Analysts”. An article in the Washington Post, humorously titled “Why ‘analyst’ is the most meaningless job title around”, found that the vague job title could be used to cover an average salary range of $40,000 – $120,000 USD. This suggests that “Analyst” (and similarly, “Associate”) is used as a generic title to cover a large range of responsibilities (see the latest analyst job openings).

The other job title categories are more useful in understanding market trends. After “Analyst” and “Associate”, Accountants and Financial Reporting job titles were most common. This was followed by various Fund Operations roles and “Attorney/Counsel” jobs.

If you’re looking for the most common job in the largest private equity and venture capital hiring market, you’re probably going to go for Analyst in London, working in the Accounting and Control department. Employment trends are constantly shifting, though, as the figures above demonstrate. Job Search Digest has been monitoring the private equity and venture capital employment opportunities for over a decade.

If you are interested in learning more about what jobs are available in this sector, visit us athttps://www.jobsearchdigest.com/private-equity-jobs