Private Equity Hiring Trends – Q4 2015

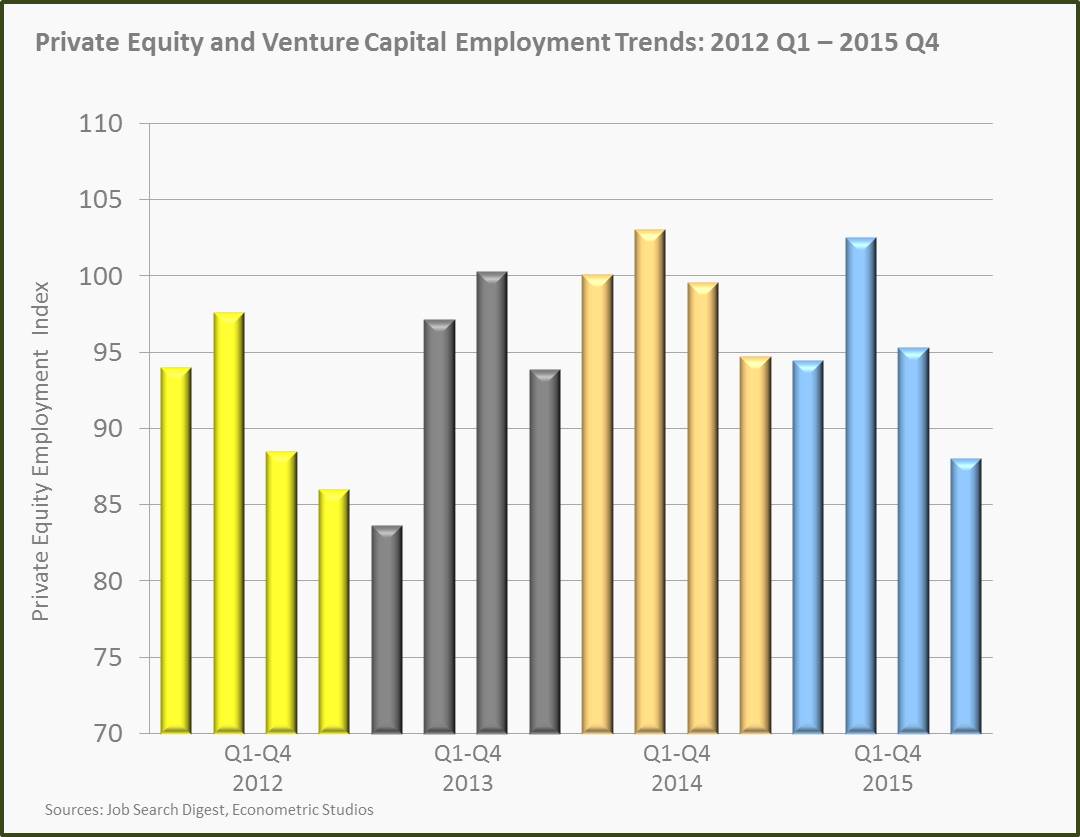

Private Equity and Venture Capital employment experienced a quick fall in Q4 2015, contrasting to the situation that existed in the past 2.5 years. Steep declines in the number of new job openings represent changes in dynamics compared to the previous quarters.

The sudden fall in job openings can be attributed to various reasons ranging from continued decline in year over year revenue growth of companies, rise in interest rates (interest rates rose by 0.25% in US in Q4 2015) and banks disliking leveraged deals.

Christopher Elvin from Preqin says, “2015 has presented a slower-paced private equity fundraising market, as firms struggled to maintain the level of new investor commitments from 2014. Moreover, record levels of dry powder suggest that fund managers are finding it increasingly challenging to effectively deploy capital into attractive opportunities.”

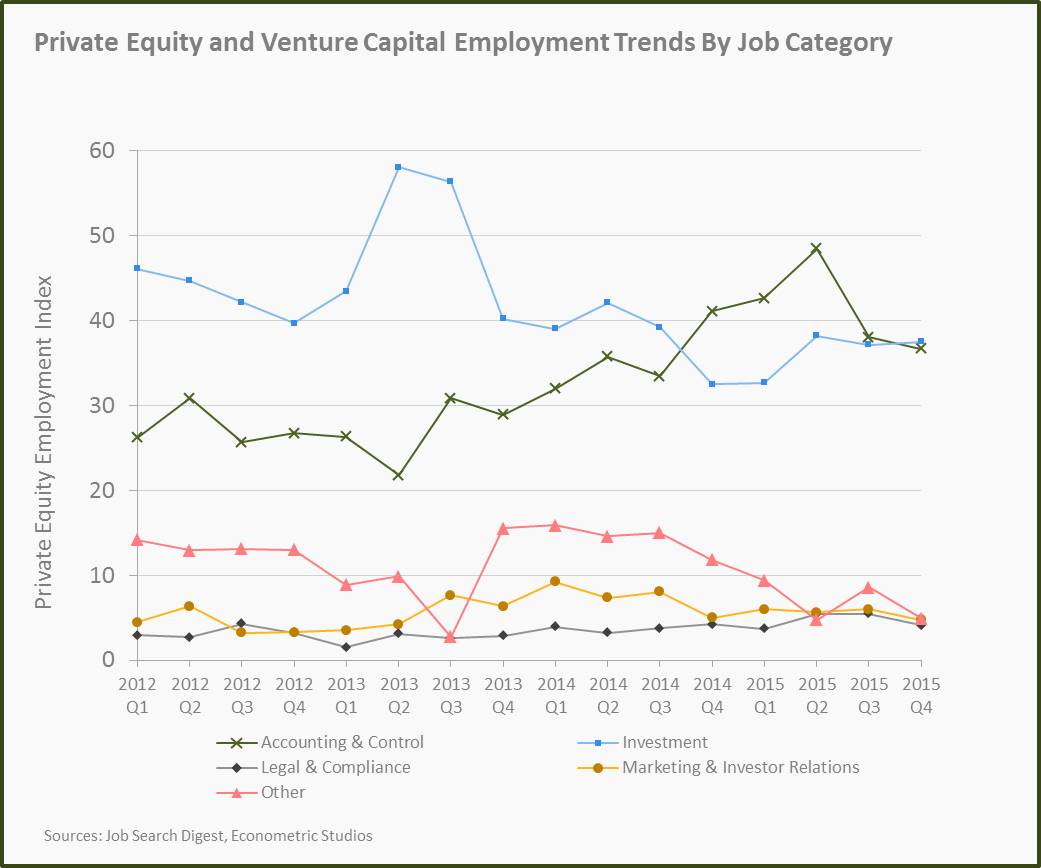

Most job categories posted declines, with the demand for accounting and control jobs continuing to decline from Q2 2015. Falling, or weak, growth in new job openings across most job categories represents increasing weaknesses in private equity and venture capital’s growth prospects for the near future.

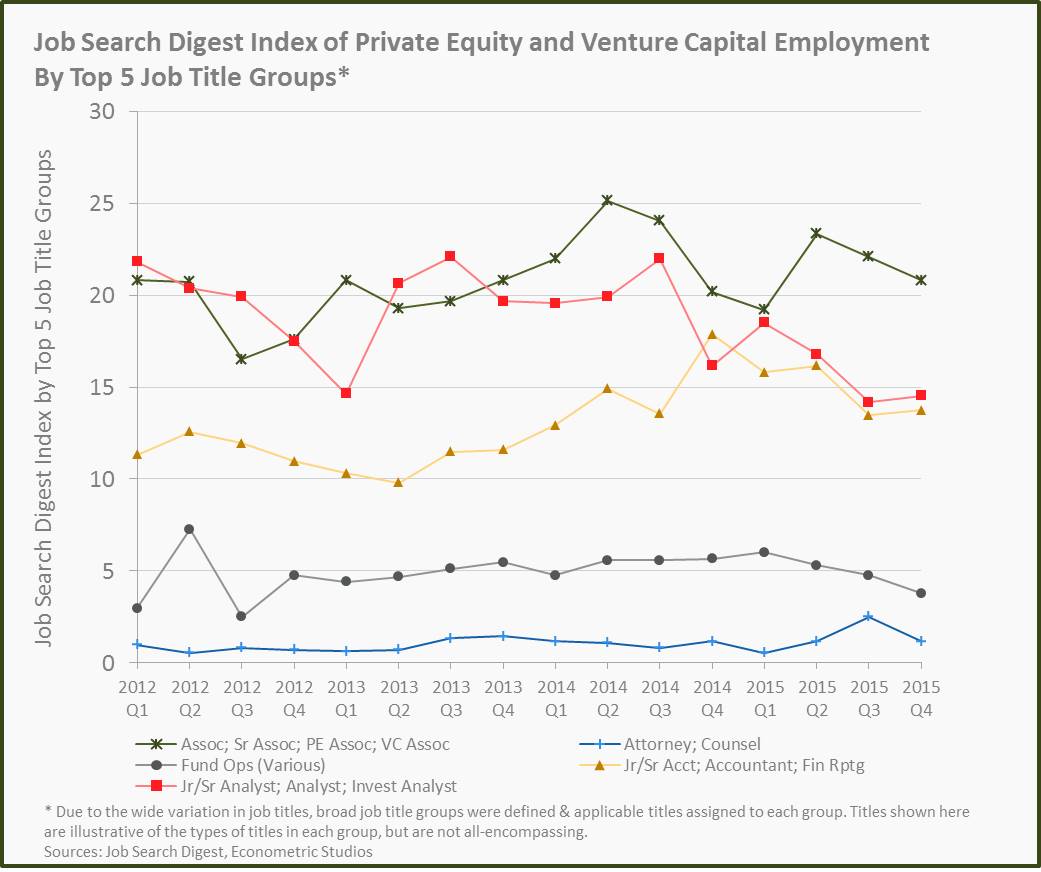

The demand for across job titles declined overall throughout the year with only Analyst and Accounting positions growing modestly in the last quarter. Compared to the 4th quarter 2014, the only title showing an increase in demand was in the Associate job family; Attorney/Counsel remained almost the same as compared to the year-ago quarter.

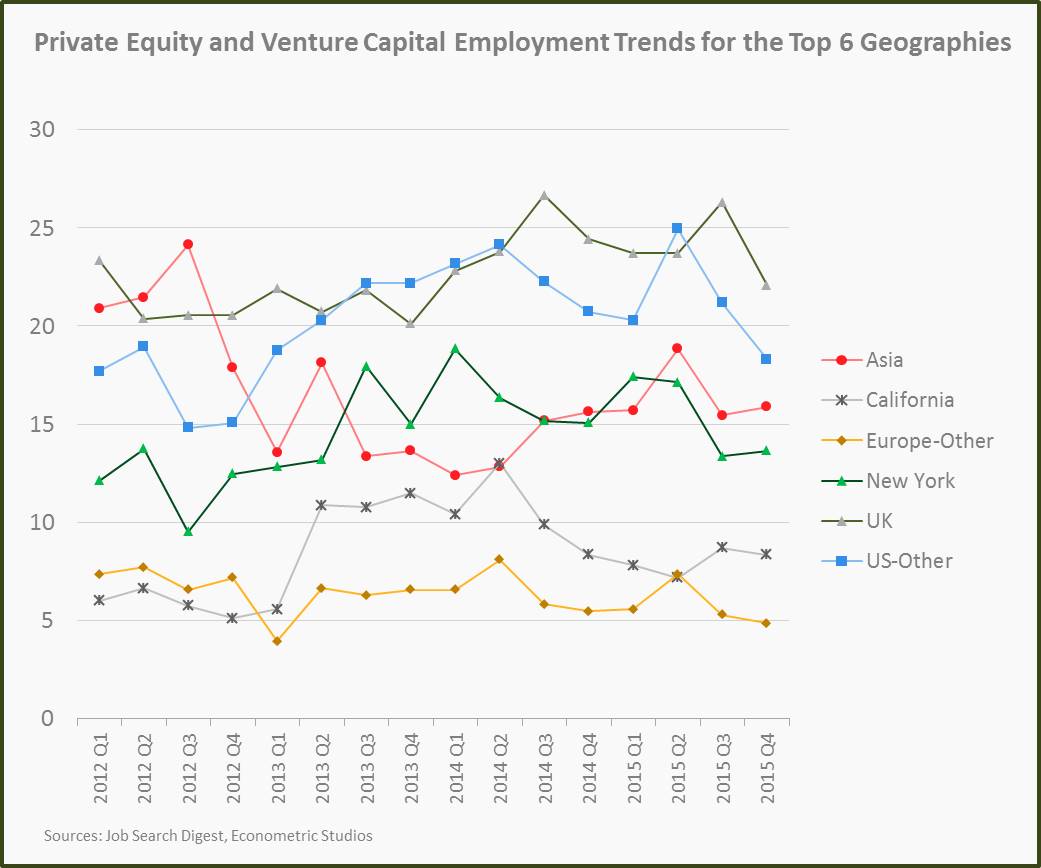

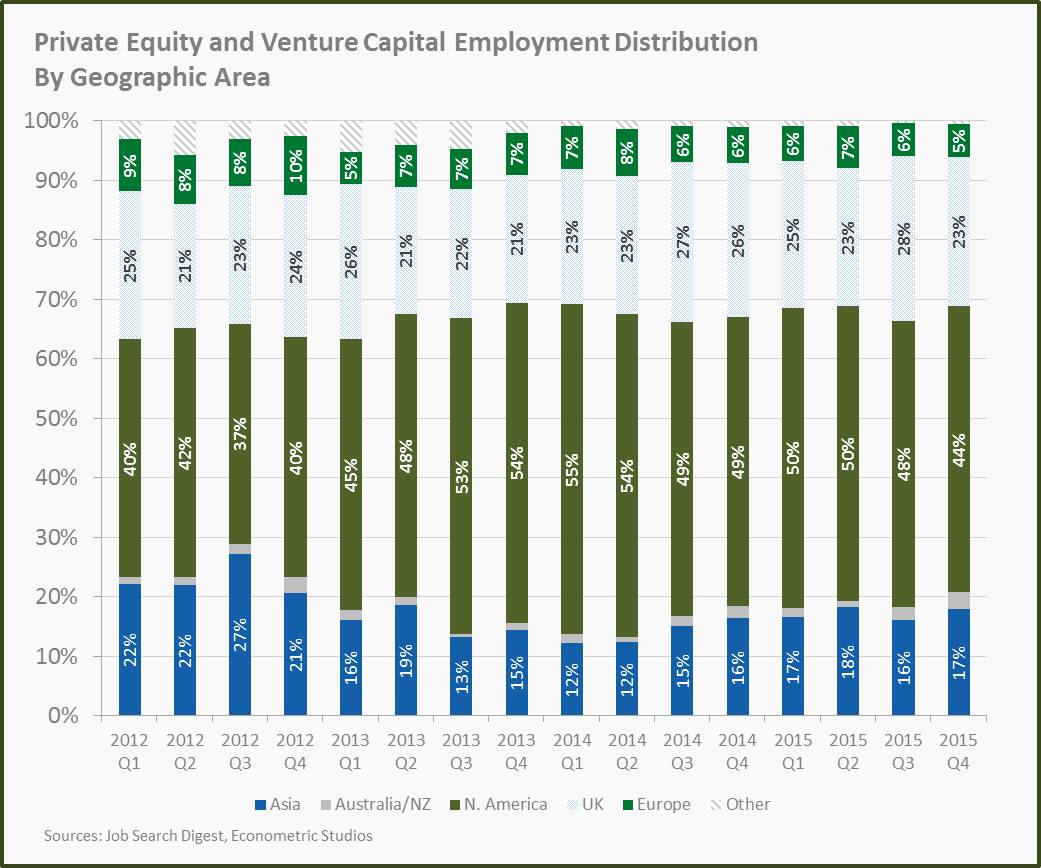

Employment trends across the top geographies reflected growth problems, except in Asia where job openings grew, and California reported a stable employment trend in Q4 when compared to the same quarter in 2014. Volatility in employment trends in the top six geographies increased in 2015 compared to 2014, especially in the last two quarters of 2015.

“An uncertain global economy, a projected slowdown in China, and expected interest rate increases following the recent increase in the US appear to be driving many VC investors to be more cautious,” KPMG and CB Insights Report.

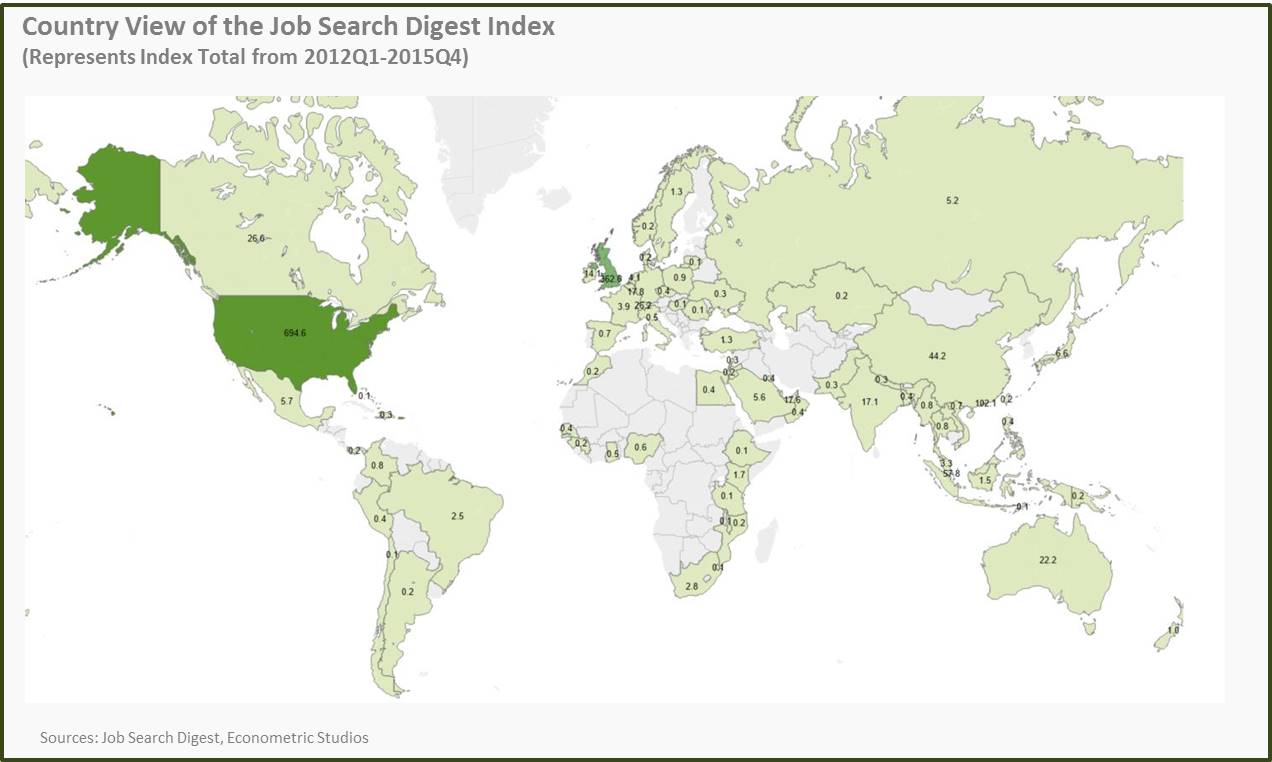

Major geographic markets posted declines in the final quarter of 2015. Private equity and venture capital employment in North America declined considerably, as global economic growth concerns and expected rise in funding costs of venture capital firms in the United States had a large negative impact on employment in this area. The second major market, the United Kingdom, posted 3% decline in hiring.

To some extent, employment in North America is likely to be impacted by interest rate expectations for the near future.

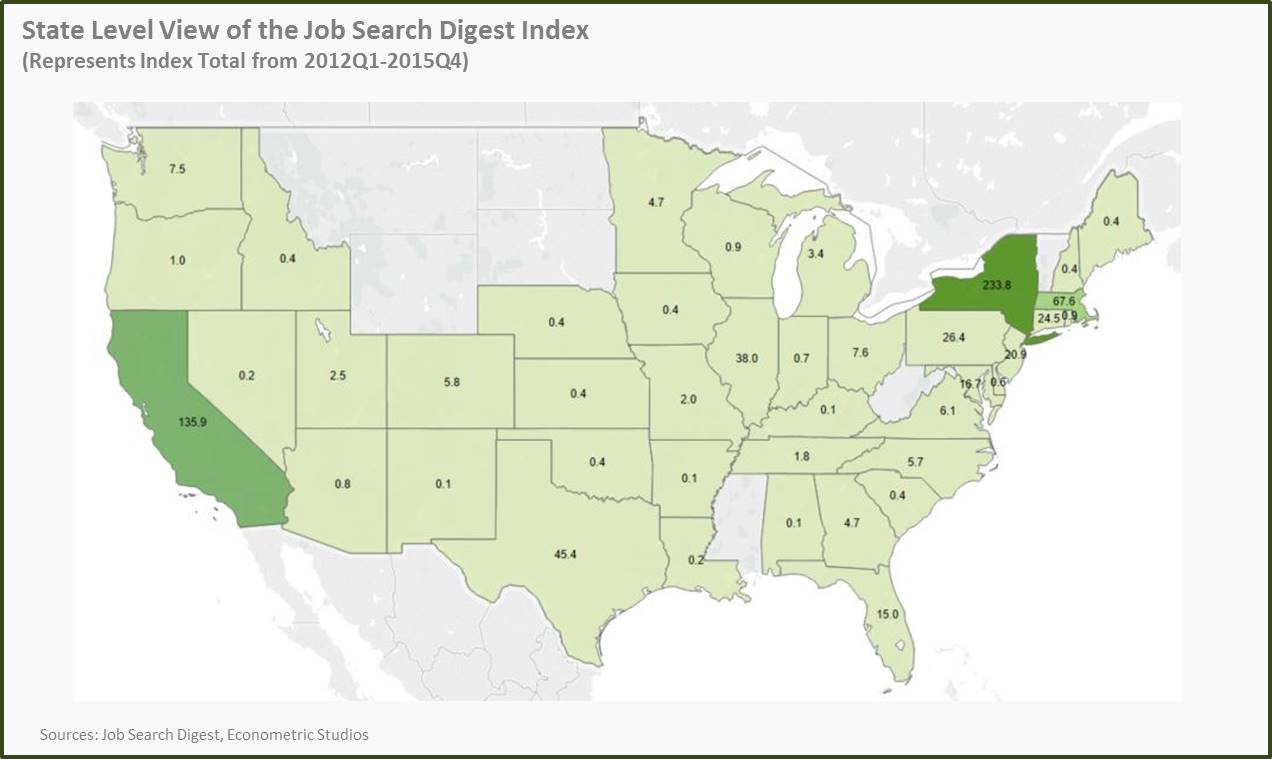

Number of IPOs in North America fell short of recent private valuations, increasing the negative concerns of venture capital investors; this will force investors to be more cautious in 2016. Nonetheless, the bulk of hiring continues to take place in the United States.

The two biggest markets within the United States (New York and California) posted considerable growth in private equity and venture capital employment, while demand for job openings declined in Texas, Minnesota and some other states.

“While Q4’15 VC investment may have declined across many industries, one sector that saw a significant upward curve over the quarter was education technology. In Q4, buoyed by a number of $100M+ deals, VC investment in Ed Tech grew over 300 percent compared to Q3 – from $295 million to over $1 billion.” KPMG and CB Insights Report.

While expectations of rising interest rates in United States have evaporated for some time due to the turmoil in energy sector and negative interest rates in some developed economies, it is again on the table, as the US economy showed strong signs of positive movement in June 2016 Jobs report. This could create some negative impact on private equity and venture capital employment in the latter part of 2016.

PE Hiring Trends Archive:

Private Equity Hiring Trends 2015 Q3

Private Equity Hiring Trends 2015 Q1-Q2

Private Equity Hiring Trends 2011-2014