Private Equity Hiring Trends – Q1/Q2 2015

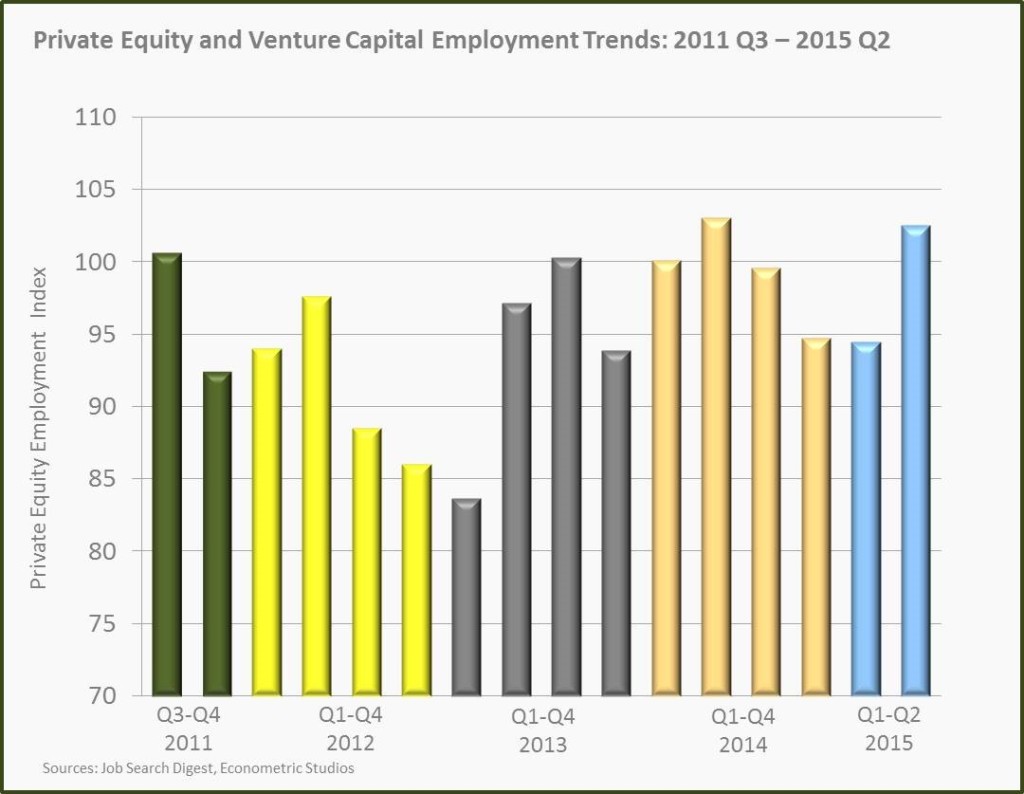

After Private Equity and Venture Capital employment dropped in the last two quarters of 2014, it stabilized in Q1 2015. In the following quarter, firms offered significantly more job opportunities. There were almost as many new job openings in Q2 2015 as in Q2 2014, which has been the highest level for the last four years.

The private equity market developed well in 2014. In early 2015, industry experts indicated that they expected that trend would continue in 2015 and predict more than $400 billion in private equity fundraising. The second quarter in 2015 saw the highest exit volume ($125 billion) on record, reported the Private Equity Growth Capital Council. The impact of this will likely be reflected next quarter and beyond.

Venture capital markets are growing as well. The year “2014 has been a successful year…and 2015 has the potential to follow suit,” says the research company, Prequin. According to their research, the amount of capital invested in venture capital was on an all-time high of $34 billion in Q2 2015. Therefore, it would appear that companies ramped up employment in order to be prepared for a stronger market.

European markets also experienced a revival in 2014, with double digit growth rates, according to PWC. The number of buyouts had increased by 20%, with Germany, Austria and Switzerland being the most promising markets. Although growth is expected to slow down throughout 2015, expectations are still high.

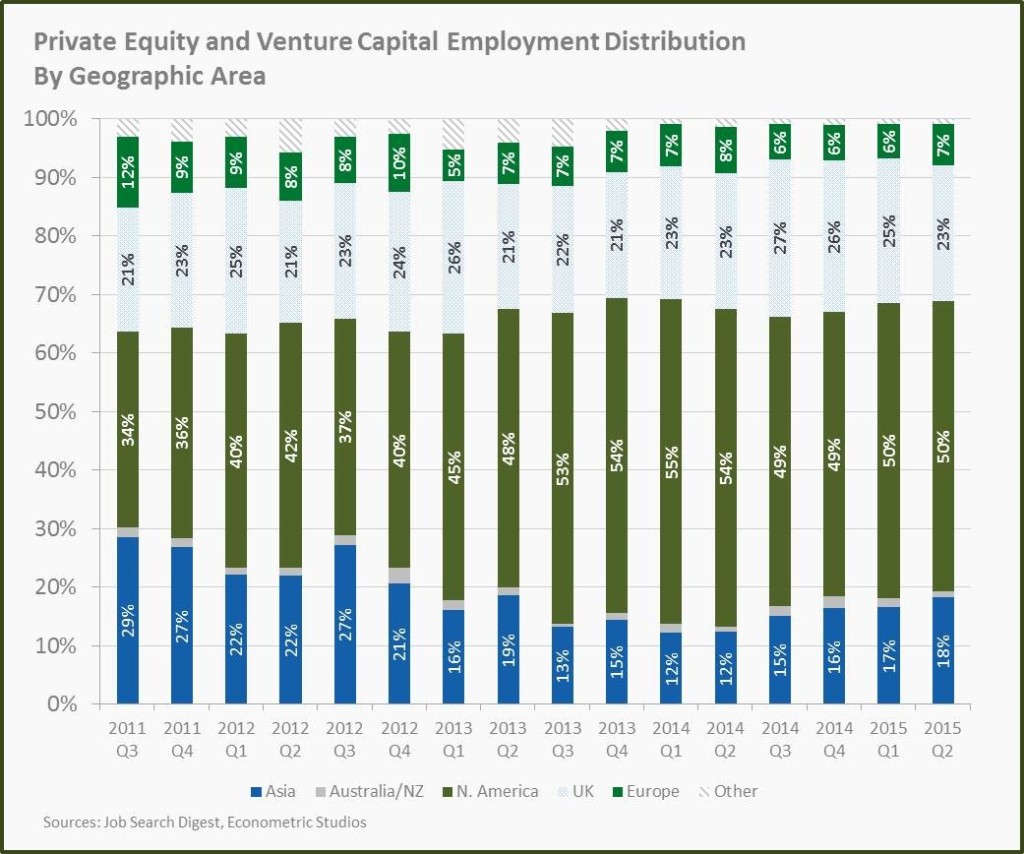

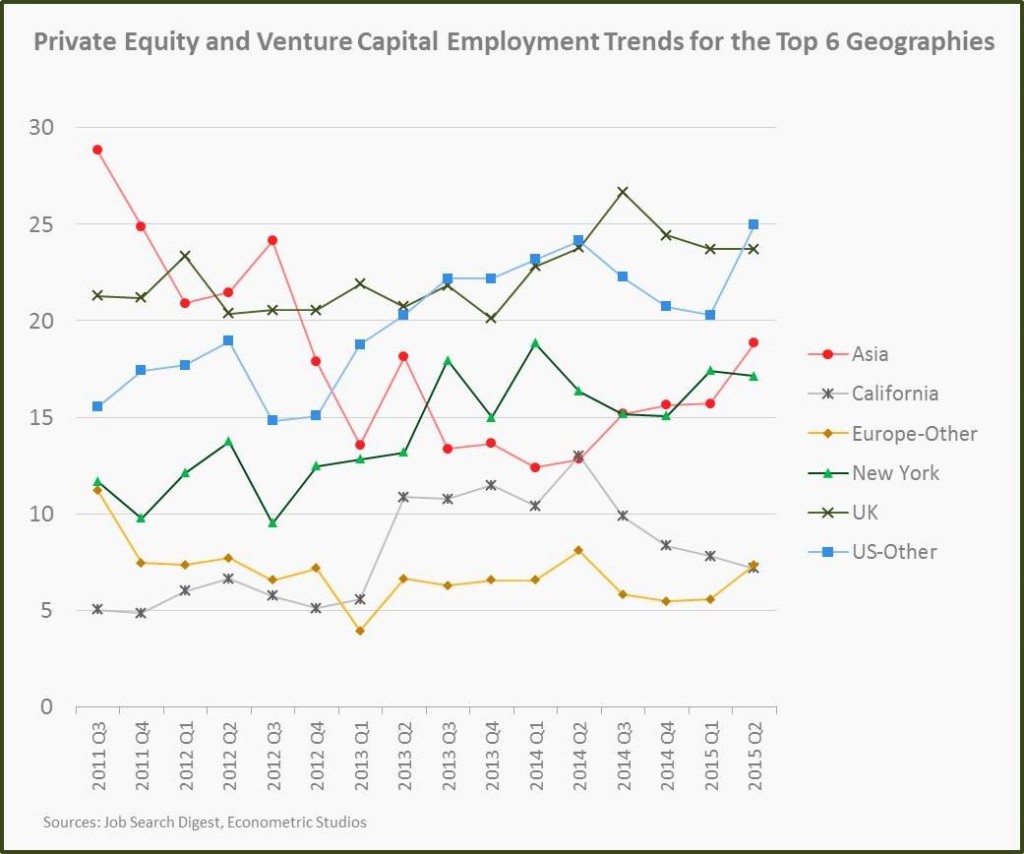

Although the European markets performed well in 2014, employment actually dropped slightly. However, with the markets remaining stable in 2015, employment has gone up by a small margin in the first two quarters of the year in Europe, whereas it has been stagnant in the US and decreasing in the UK.

Moreover, Asia showed modest employment growth in Q1 and Q2 with China and Hong Kong dominating the employment markets, likely a result of the private equity activity increases in that region in 2014.

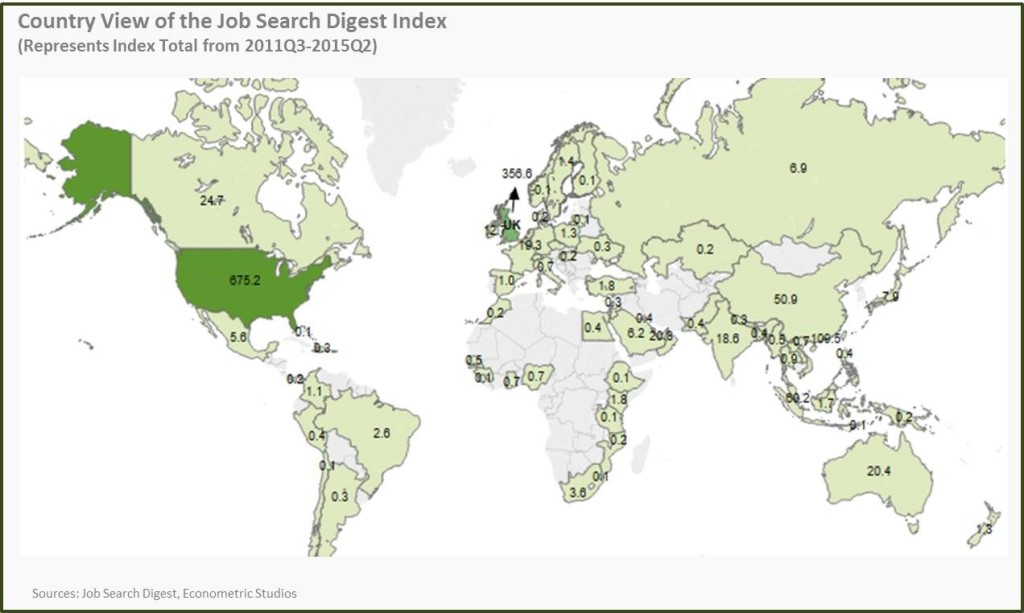

Despite these developments, the Asian market is still comparably small. The US and the UK remain the top private equity and venture capital markets.

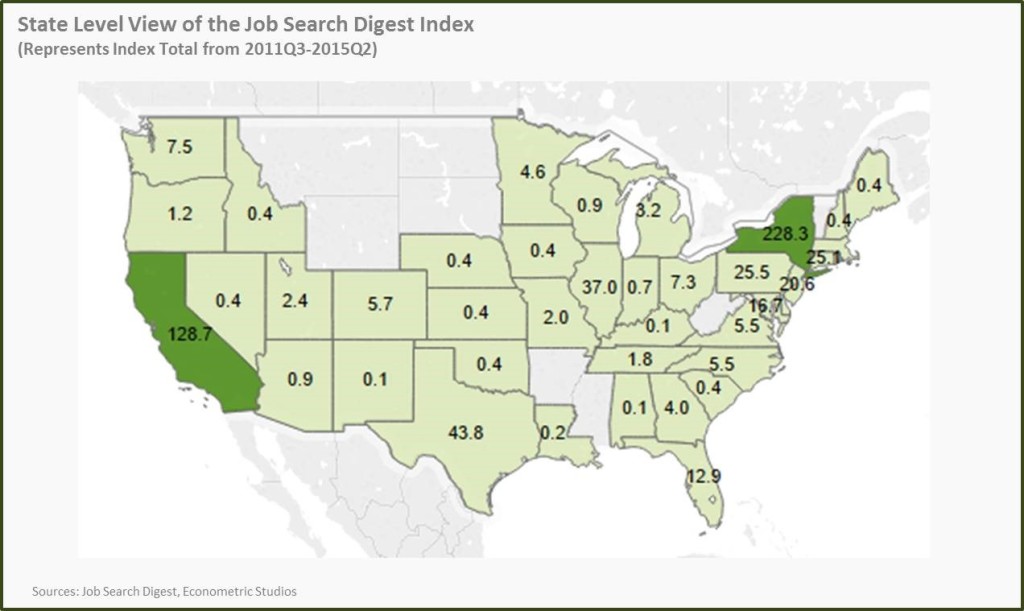

In the US, New York saw an increase in job openings in Q1 while the number of available jobs in California has been declining steadily. However, in Q2 there was a significant increase in other locations in the US. This change is likely due to the fact that thetotal number of venture capital deals in California continue to decrease in 2015 and have reached their lowest point since 2012.

Additionally, the California Public Employees’ Retirement System, which is America’s biggest public pension, is reducing the number of private equity managers. Hence, California has become less attractive for private equity and venture capital firms and it seems as if other locations apart from the hubs are becoming more interesting.

It appears that venture capital healthcare deals are moving away from the hubs, with 44% of all healthcare deals taking place outside of the major centers. Most of the deals occurred in Missouri, North Carolina, Pennsylvania and Tennessee.

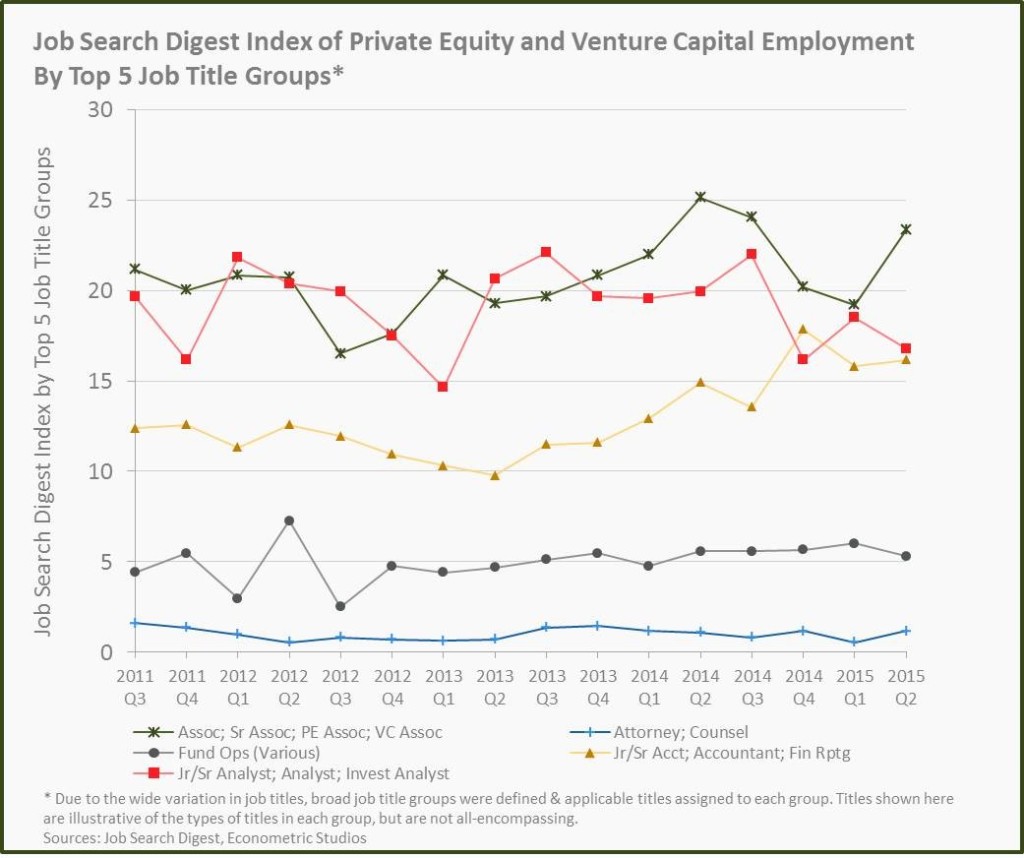

Looking at job postings in more detail, it becomes clear that the demand for accounting and control jobs is still strong, with a slight uptick in demand in the 2nd quarter of 2015.

After a drop in the 4th quarter of 2014, the demand for analysts jumped in Q1 2015 but went decreased again in Q2 2015. This could be an indicator that employers have filled their junior positions and are now looking for more experienced candidates.

Employment opportunities have overall been showing improvement in 2015 and the market outlook is stable. “We expect 2015 to be even more active for private equity investors,” says Adley Bowden, senior director at PitchBook.

Thus now might be a good time to break into the industry. If you are interested in learning more about what jobs are available, visit us at https://www.jobsearchdigest.com/private-equity-jobs.