PRIVATE EQUITY: BIGGEST WINNERS AND LOSERS

The BIG List of Private Equity Winners and Losers

After scouring hundreds of private equity deals over the last decade and evaluating their gains and losses in revenue, profit, market value and employee numbers, we’ve been able to find the biggest winners and losers. Be sure to scroll down to the bottom of this page and let us know what you think about these deals? Did we miss any big winners or losers?

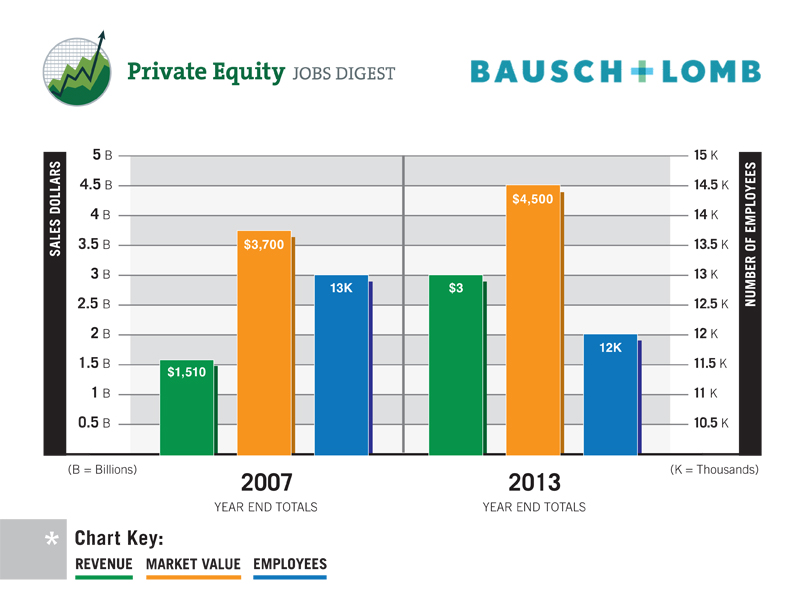

Bausch & Lomb, a global leader in eye care industry who fell into troubled times, was acquired by the private equity firm Warburg Pincus, for a total purchase price of $4.5 billion dollars. The deal included $3.67 billion in cash and the assumption of $830 million in debt. In 2013, the company was resold to Valeant for $8.7 billion – with $4.5 billion going to the investor group and $4.2 billion going to repay Bausch & Lomb debt.

Why They’re a Winner

With this acquisition, Bausch and Lomb was able to turn a corner and recover from their troubling times. With revenue up and more employees getting hired, we clearly see this as a good deal for everyone involved.

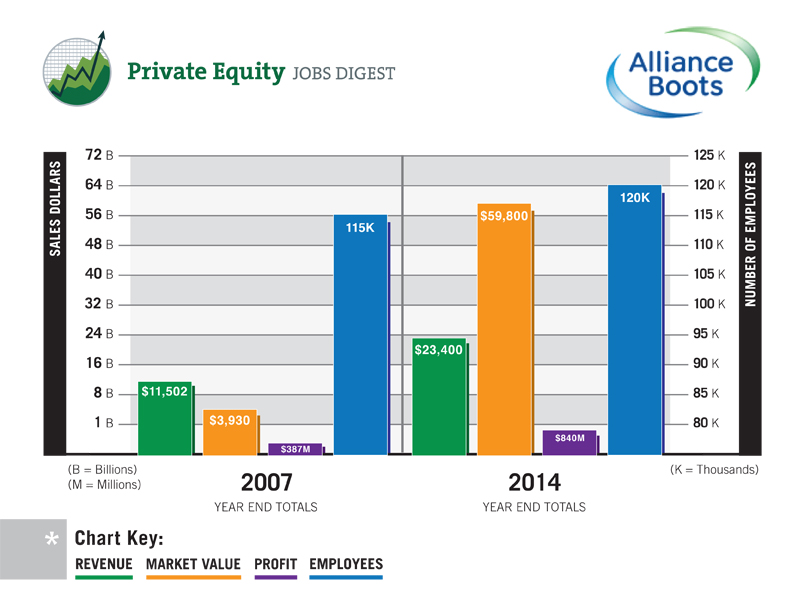

Alliance Boots

Kohlberg Kravis Roberts and Stefano Pessina, the company’s deputy chairman and largest shareholder, acquired the UK drug store retailer for £11.1 billion ($22.2 billion USD), outbidding financier Guy Hands. The takeover, which was the biggest ever leveraged buyout in Europe, gave KKR control of 3100 stores and a wholesale drug supplier to more than 125,000 pharmacies and hospitals. The buyout came only a year after the merger of Boots Group Plc (Boots the Chemist), and Alliance UniChem Plc.

Why They’re a Winner

With a 103% increase in revenue and 117% increase in profit, and an unbelievable 1,142% increase in market value, for both the company and the investors, this deal is a prescription for success!

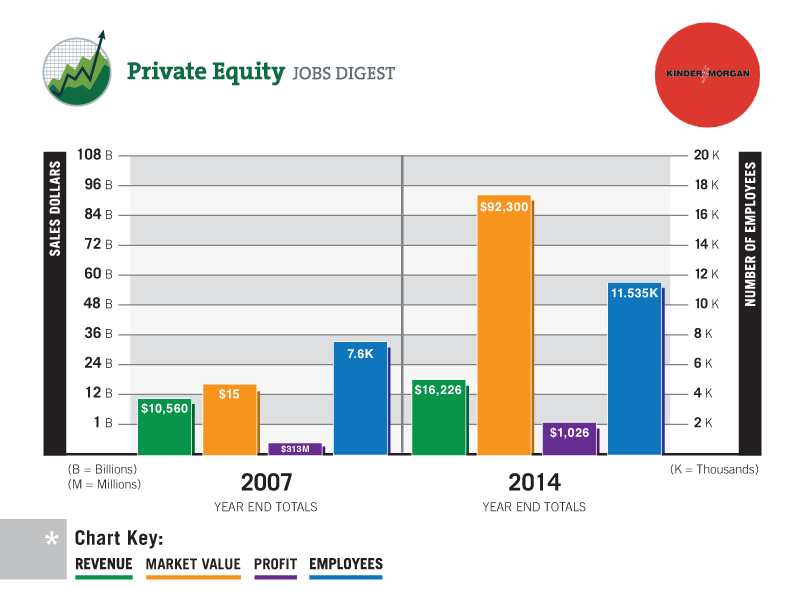

Kinder Morgan

In 2007, Kinder Morgan Inc. was acquired for $15 billion from an investor group led by the company’s chairman and co-founder, Richard D. Kinder. The buyers assumed $7 billion of Kinder Morgan debt, valuing the total deal at $22 billion.

Why They’re a Winner

While the acquisition has come under scrutiny, increased revenues, market value and profit in the double (and triple) digits gave the energy to light up all stakeholders.

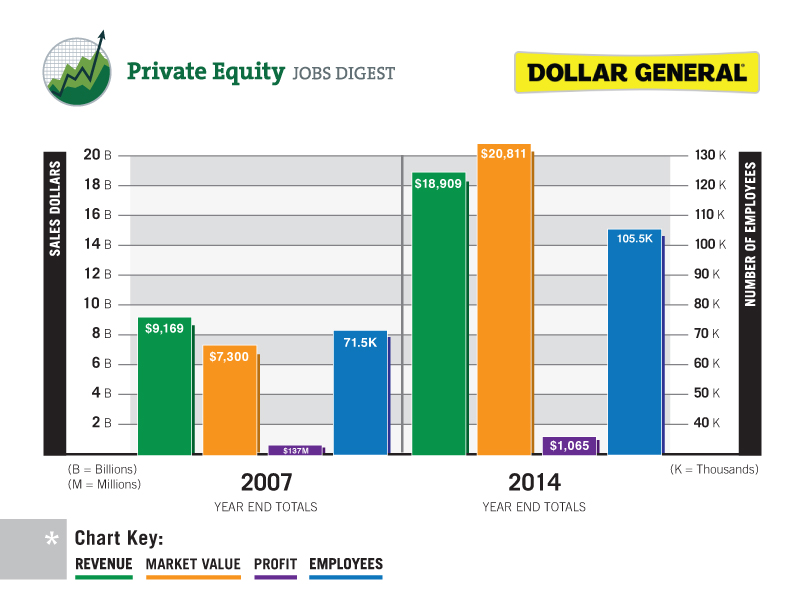

Dollar General

Dollar General, a discount retailer with more than 8,000 stores in the United States was acquired by private equity firm Kohlberg Kravis Roberts for $7.3 billion, including about $380 million in assumed debt. Kohlberg Kravis paid $22 in cash for each Dollar General share, or about 31 percent more than the shares’ closing price. Part of the acquisition plan included speeding up store closings (at the time of the deal, 400 outlets were planned to be closed) to boost profits.

Why They’re a Winner

Triple digit increases in revenue, profit and market value along with a 48% increase in employees, regardless of downsizing outlets, categorize this deal as a bargain for shoppers.

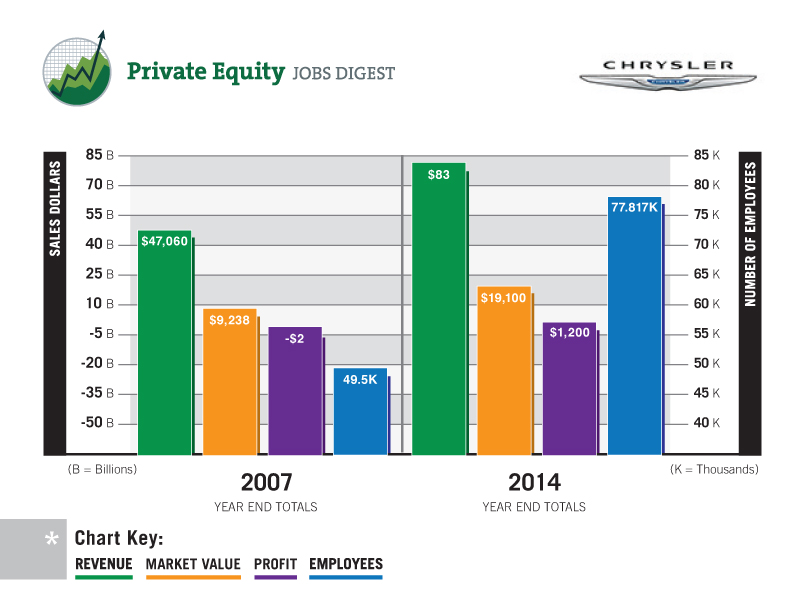

Chrysler

Cerberus’ Capital Management completed the $7.5 billion acquisition of 80.1% of the U.S. car manufacturer. Only $1.45 billion of proceeds were expected to be paid to Daimler and does not include nearly $600 million of cash Daimler agreed to invest in Chrysler.

Why They’re a Winner

Cerberus’ choice to bring in former Home Depot CEO, Robert Nardelli as the new chief executive of Chrysler to execute a turnaround of the company turned out to be a great plan. The company has seen an increase in revenue and triple digit percentage increases in profit and market value. The addition of almost 30,000 employees shows that even established brands that have traded hands can drive in the fast lane.

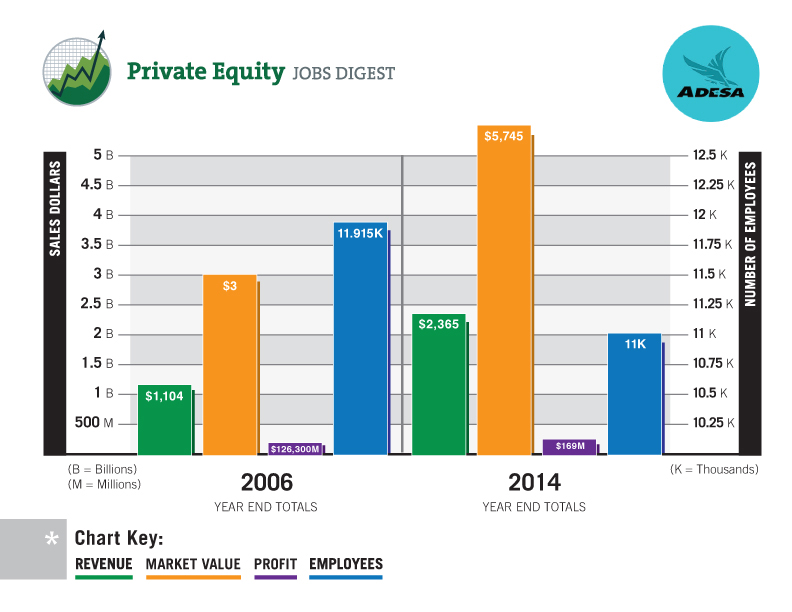

ADESA Inc.

ADESA Inc., the second-largest auctioneer of used cars in the U.S., agreed to be acquired by a group of investors including Goldman Sachs Group Inc. for $2.5 billion. Shareholders received $27.85 a share in cash, about 10 percent more than the stock’s current closing price. Goldman, Kelso & Co., ValueAct Capital and Parthenon Capital will assume $700 million in debt, putting the total transaction value, counting the transfer of a salvage-auction unit, at $3.7 billion.

Why They’re a Winner

While the number of employees has decreased, a steady increase in profit, market value and revenue in this deal… going once, going twice… was a solid bid.

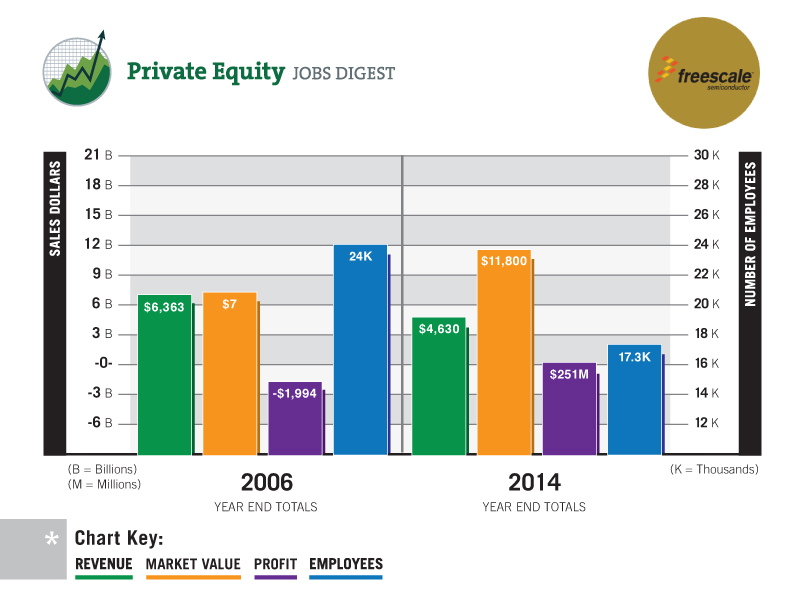

Freescale

Freescale, a global semiconductor company and maker of chips used in cell phones and cars, was bought by a private equity consortium for $17.6 billion, the largest-ever buyout of a technology company. The consortium acquired all of the outstanding Class A and Class B shares of Freescale FSL.

Why They’re a Winner

With decreases in revenue and employees (27% and 28% respectively), this deal sat on the edge of becoming a Loser. But a triple digit increase in profit (113%) coupled with a 69% increase in market value, tipped the scales and sent this technology deal into the win column.

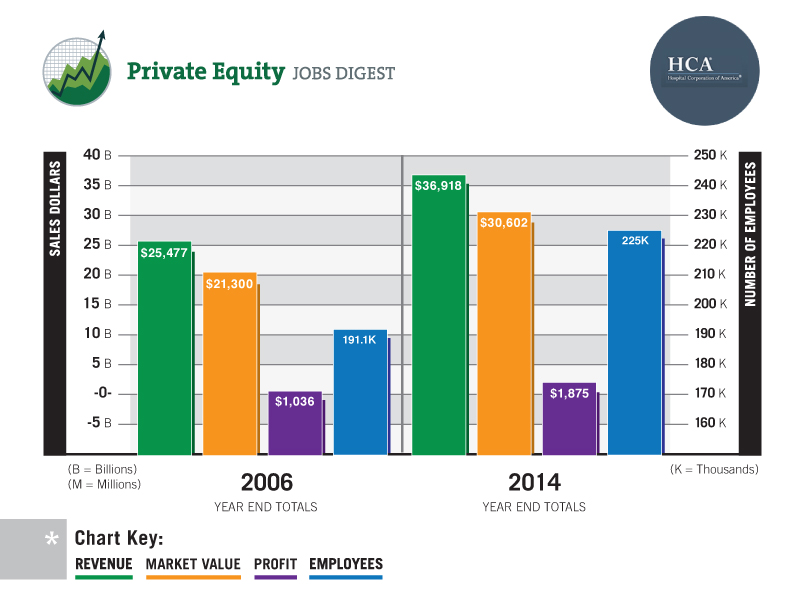

Hospital Corporation of America

Hospital operator HCA Inc. was acquired at $21.3 billion, not including the value of HCA’s debt, by a consortium. Factoring in HCA’s debt load of $11.7 billion, the deal narrowly tops the record-setting leveraged buyout of RJR Nabisco in 1989.

Why They’re a Winner

While not as impressive as some of the other deals we reviewed, because this deal saw an increase in all measured factors, including an 81% increase in profit, we think the prognosis is a good one.

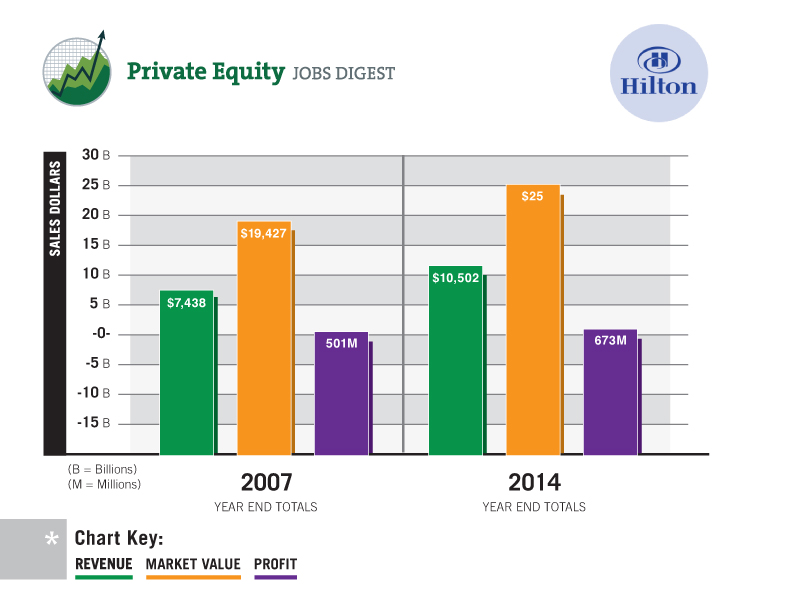

Hilton Hotels

In 2007, the Blackstone Group bought Hilton Hotels in a $26 billion deal that added one of the largest U.S. hotel chains to the list of companies bought out by the private equity firm that year. The amount Blackstone paid was a 40 percent premium over its last closing price and the deal included $7.5 billion in debt.

Why They’re a Winner

Increases in profit, market value and revenue during the review period booked a reservation in the winner column.

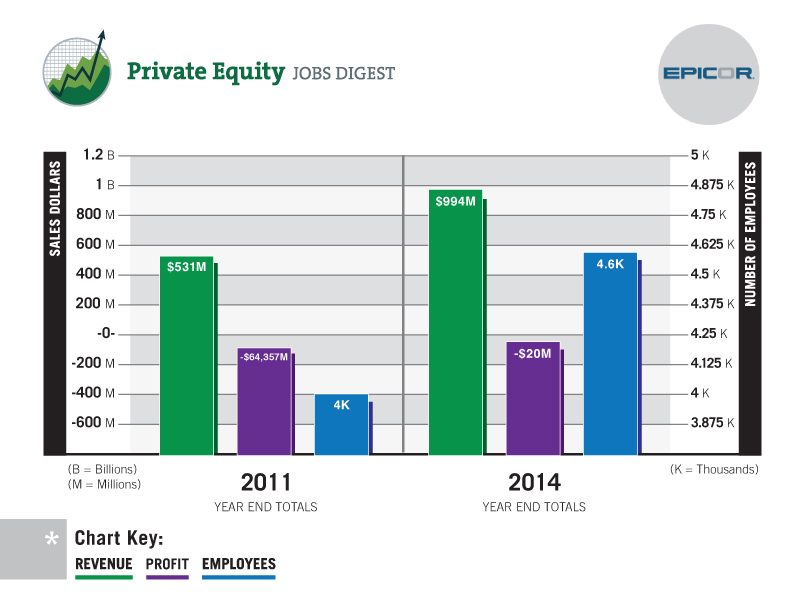

Epicor

Business software maker Epicor was acquired by private equity firm Apax Partners, valued at approximately $976 million. The deal represented a premium 11.2% over Epicor’s stock price and 34.4% over the average close price for the previous 52 week period.

Why They’re a Winner

With strong increases in revenue and profit, along with a 15% increase in employees, Epicor has the resources to plan for long term success.

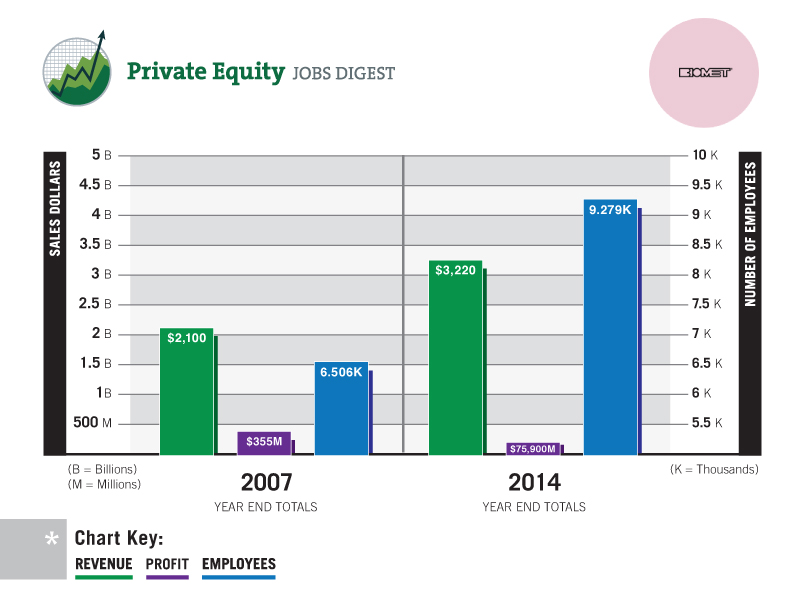

Biomet, Inc.

Biomet, Inc. a worldwide leader in the design and manufacture of musculoskeletal medical products, entered into a definitive merger agreement in 2007 to be acquired by a private equity consortium in a transaction with a total equity value of approximately $10.9 billion. The consortium included affiliates of the Blackstone Group, Goldman Sachs Capital Partners, Kohlberg Kravis Roberts & Co. and TPG. In 2014, the company was acquired again by Zimmer Holdings, in a deal valued at $13.35 billion including debt.

Why They’re a Winner

Our analysis prior to the Zimmer buyout showed that the company was able to increase revenue by 53 percent and it’s employees by 43%. It looks like more than just bone growth is getting stimulated at Biomet and, as a result, it earned winner status.

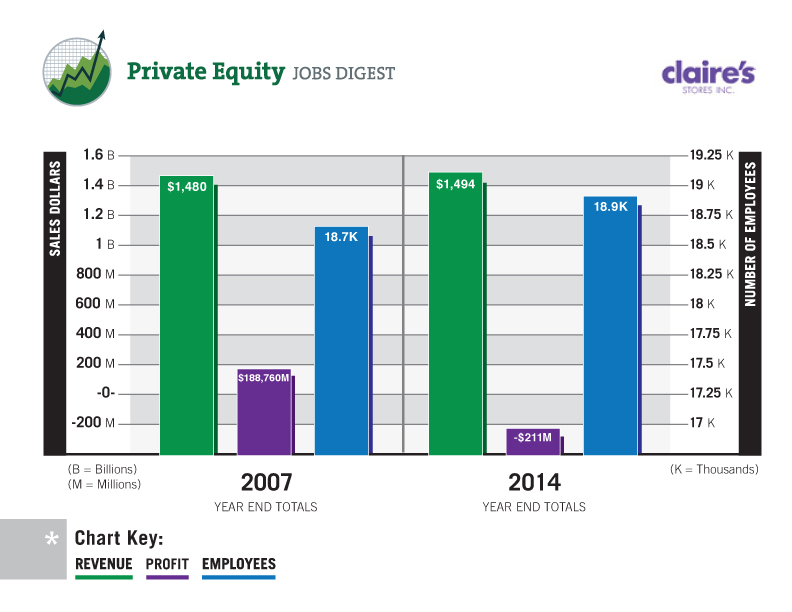

Claire’s Stores

Teen accessories retailer Claire’s Stores was acquired by private equity firm Apollo Management in a $3.1 billion takeover deal. The company, which operates mainly in the U.S., hoped that the transaction would boost its presence abroad.

Why They’re a Loser

Over the seven year analysis, Claire’s Stores saw a 1 percent increase in both revenue and employees. Unfortunately, with its negative 212% profit change Claire’s might be attractive to tweens but long term investors should look for it on the clearance rack.

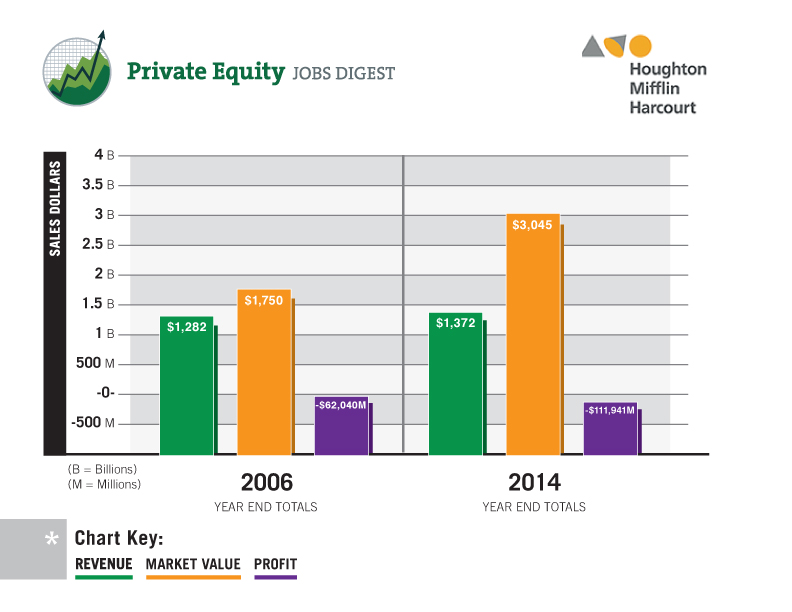

Houghton Mifflin

Vivendi sold Houghton to private equity investors Thomas H. Lee Partners,Bain Capital, and Blackstone Group for $1.66 billion, including assumed debt (approximately 25% less than Vivendi had paid a year earlier).

Why They’re a Loser

Looks like the investors need to spend a bit more time hitting the books in order to make the grade.

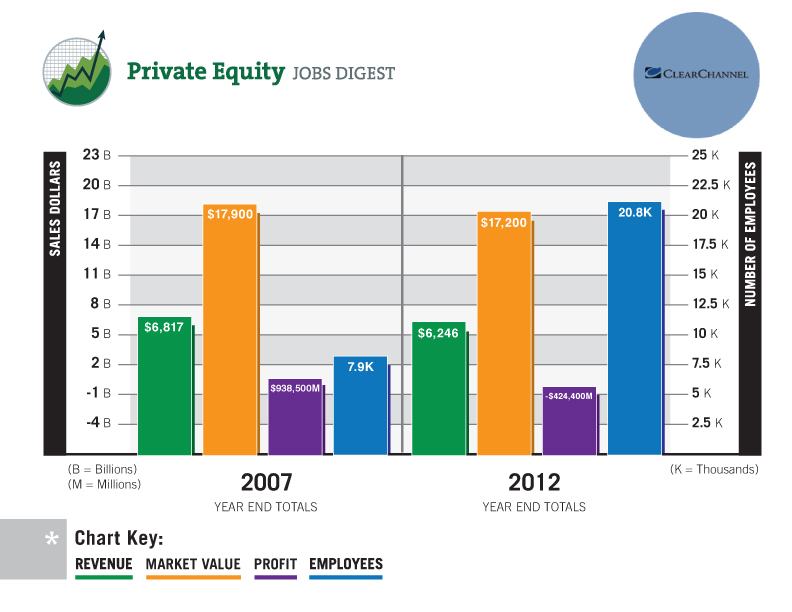

Clear Channel

Private equity firms Thomas H. Lee Partners and Bain Capital completed the $17.9 billion purchase of radio-station and billboard company Clear Channel Communications Inc. The deal, which had been slowed by legal battles in two states, and negotiations to lower the purchase price, closed almost two years after Clear Channel began exploring strategic options in October 2006.

Why They’re a Loser

The single digit percentage losses in revenue and profit moved this deal towards the Loser column, but it was the 145% reduction in profit that cleared its spot as a low-ratings Loser.

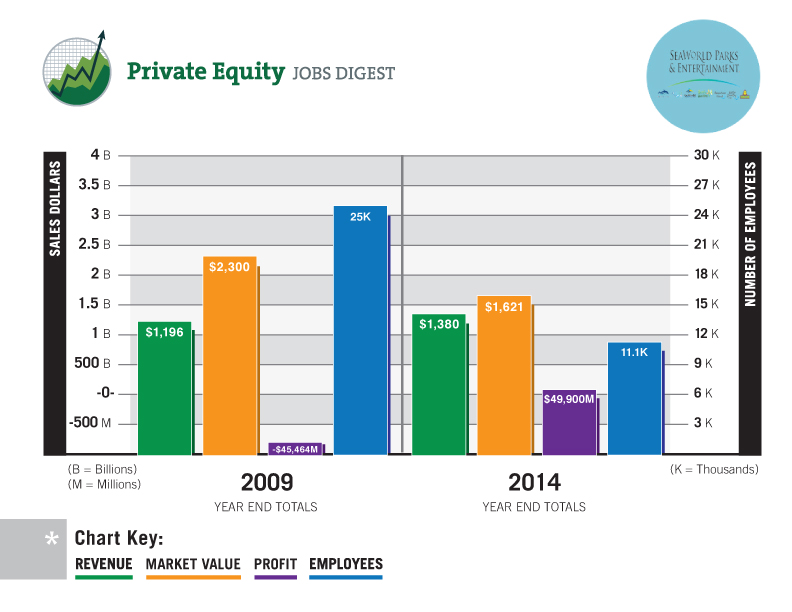

Busch Entertainment

Anheuser-Busch InBev sold its theme park business, including the Sea World and Busch Gardens parks, to buyout firm Blackstone Group for up to $2.7 billion. Blackstone will pay the world’s largest brewer $2.3 billion in cash and up to $400 million on whatever return it makes on Busch Entertainment Corp. (BEC), the second-largest U.S. entertainment park operator.

Why They’re a Loser

Even though this deal saw an increase in profit and revenue, the 30% decrease in market share coupled with the over 50% cut in employees leaves us no option but to deem this a black fish deal and toss it back.

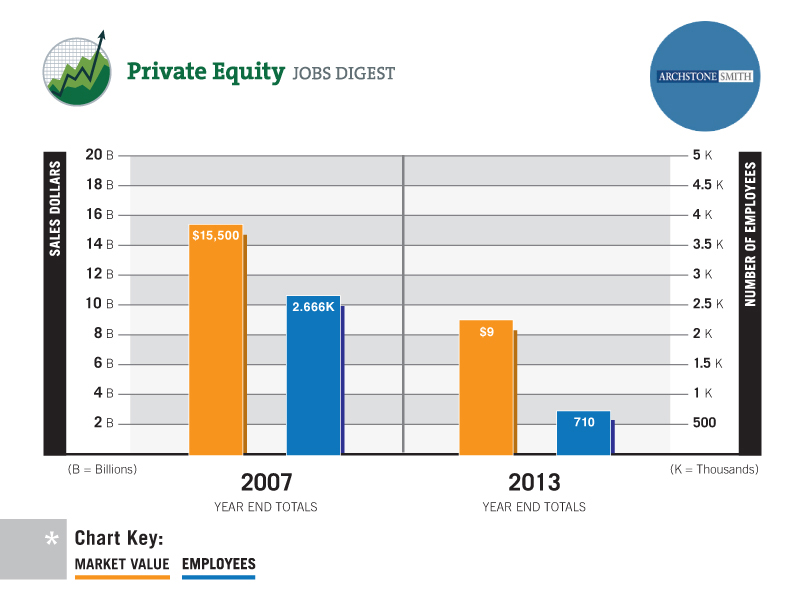

Archstone-Smith

Archstone-Smith, a major owner of apartment buildings was bought by a Tishman Speyer-led consortium valuing the company at about $15.5 billion in 2007. In 2013, the firm was sold to Equity Residential and AvalonBay Communities for $9 billion.

Why They’re a Loser

Only able to retrieve limited details of this deal over a seven year period, the simple fact that they had a 42% decrease in market share and a 73% decrease in employees leaves a large vacancy for stakeholders.

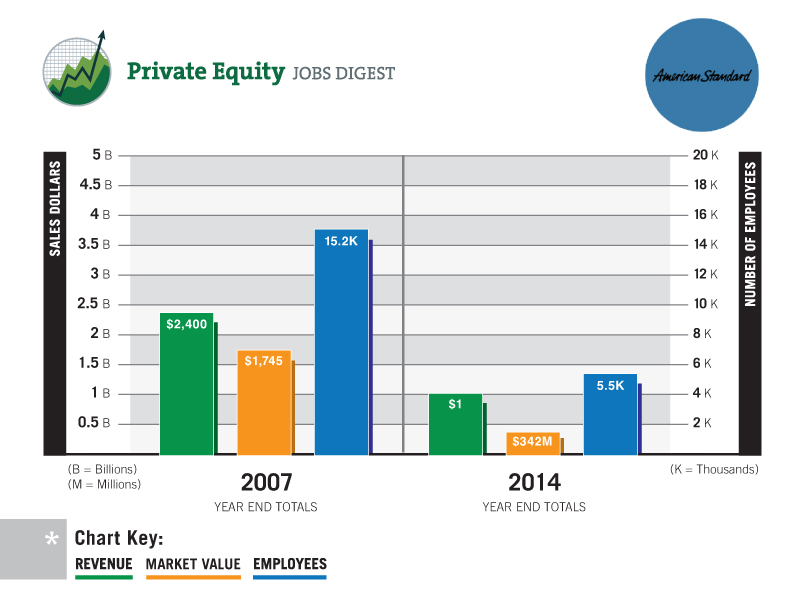

American Standard

Investment firm Bain Capital Partners purchased a portion of the American Standard company assets for $1.76 billion. The sale allowed gave Bain Capital control over the kitchen and bath division of American Standard.

Why They’re a Loser

With losses across the board, including over 2/3 of its employees, this deal should have been flushed down the drain.

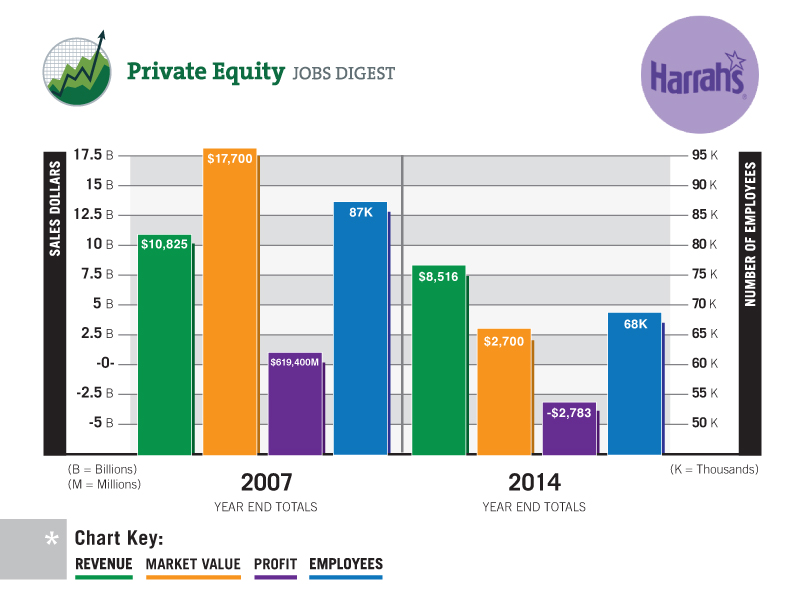

Harrah’s Entertainment

The $17.7 billion buyout of Harrah’s Entertainment by two private equity firms, Apollo Management and Texas Pacific Group, was the fourth largest private equity buyout ever at the time. The transaction, which included the assumption of $10.7 billion in debt, totaled approximately $27.8 billion

Why They’re a Loser

There was just nothing positive about this deal! With an over 500% decrease in profit and 97% decrease in market value, this deal was not worth the gamble.

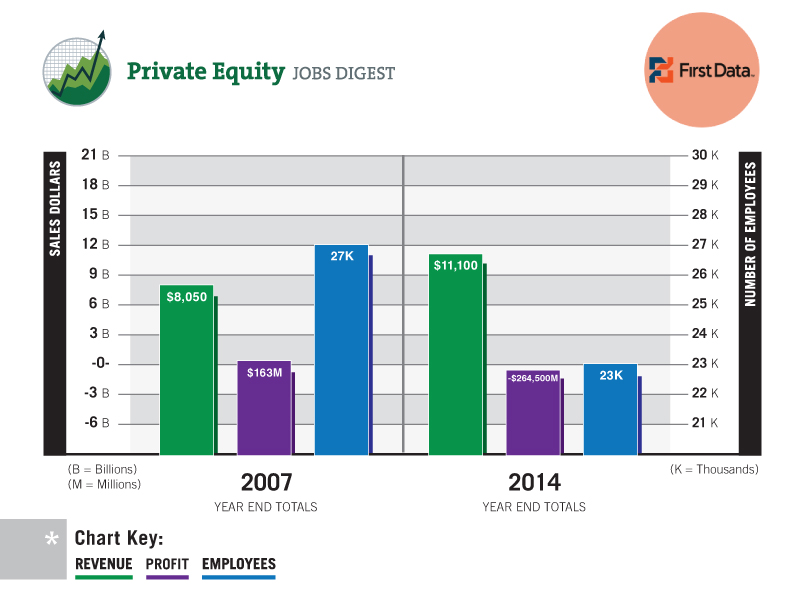

First Data

Kohlberg Kravis Roberts and TPG Capital completed the $29 billion buyout of the credit and debit card payment processor and former parent of Western Union in late 2007.

Why They’re a Loser

Although there was an increase in revenue, drastic decreases in profit and employee numbers show that this deal might be a chargeback in process.

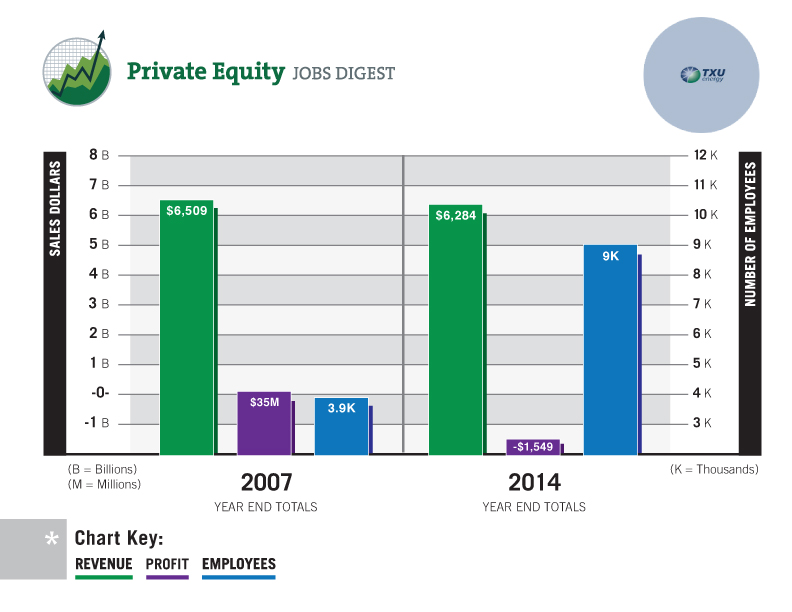

TXU Energy

An investor group led by KKR and TPG Capital and together withGoldman Sachs Capital Partners completed the $44.37 billion buyout of TXU Energy, the regulated utility and power producer. The investor group had to work closely with ERCOT regulators to gain approval of the transaction but had significant experience with the regulators from their earlier buyout of Texas Genco.

Why They’re a Loser

While we were encouraged by the increase in employees at TXU over the seven year analysis period, the massive drop in profit of 4,326% and revenue decrease, we think the lights are a little dim at TXU.

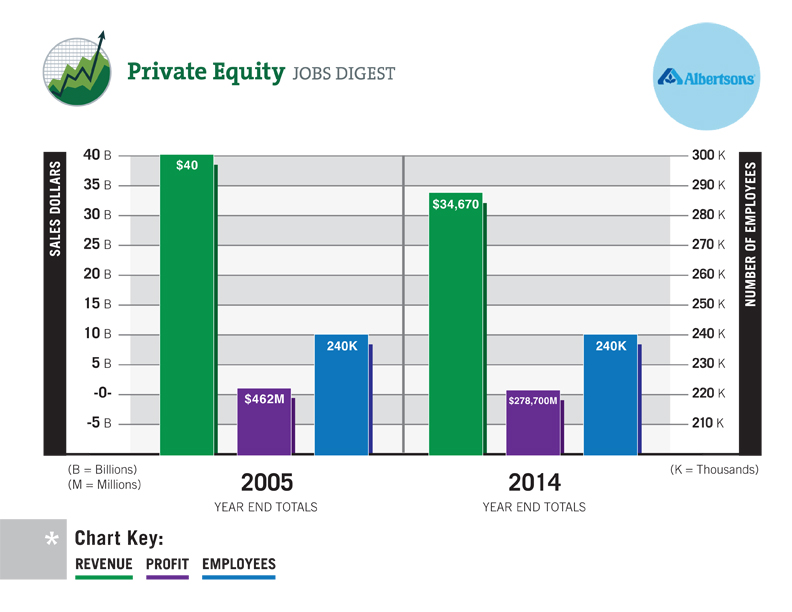

Albertsons

Albertsons accepted a $15.9 billion takeover offer ($9.8 billion in cash and stock and the assumption of $6.1 billion in debt) from SuperValu to buy most Albertson’s grocery operations. The drugstore chain CVS Caremark acquired 700 stand-alone Sav-On and Osco pharmacies and a distribution center, and a group including Cerberus Capital Management and the Kimco Realty Corporation acquired some 655 underperforming grocery stores and a number of distribution centers in the deal.

Why They’re a Loser

With heavy losses in both profit and revenue, it might been better to take this deal out of the basket and put it back on the shelf.

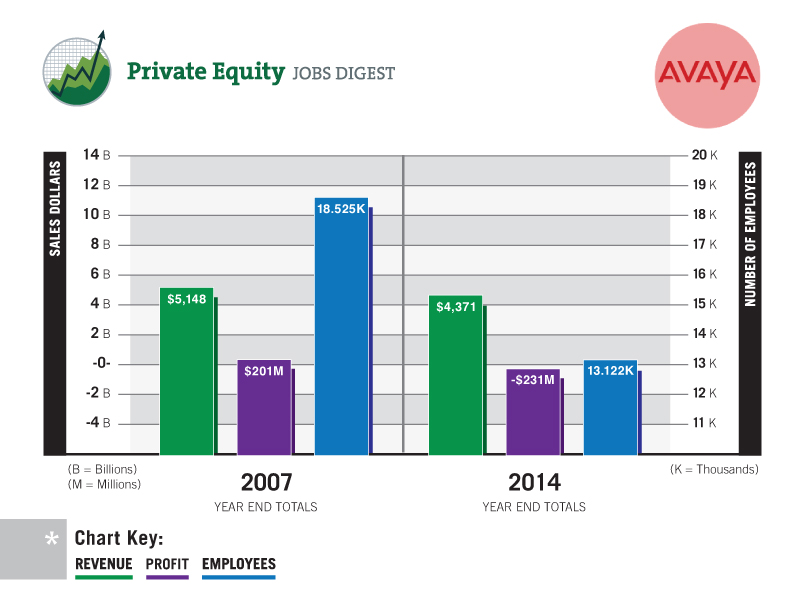

Avaya

Noted as the largest leveraged buyout of a computer-networking company at the time, Avaya Inc. was acquired by Silver Lake Partners and TPG Inc. for $8.2billion.

Why They’re a Loser

While this deal showed great potential, as Avaya was the leader in its space generating about $5 billion in annual revenue prior to the acquisition, tracking over the seven year period showed serious losses across the board, and a stakeholder disconnect.