Private equity continues to be an attractive career path for new grads and seasoned financial veterans alike. The firms are very selective about who they hire, when they hire, and as most firms are small in terms of staff size, they typically only hire a few new people each year.

The good news, for those looking for private equity jobs, is that there is no default profile for the perfect candidate. These firms hire based on need and their needs vary based on many different factors.

Competition for a Small Number of Private Equity Jobs

If you are an undergraduate or even a newly-minted MBA, you might find it tough to break into private equity. You will find yourself competing against a number of ex-bankers and other financial professionals who have years of experience. These more experienced private equity professionals bring to the table the skills necessary to hit the ground running immediately when they join a firm.

The Usual Suspects

If you are determined to join the private equity ranks, it is no surprise that it helps to have a great network of contacts and to go to the right schools.

Ivy League schools have long been the schools of choice for those in private equity. Stephen Schwarzman, founder of the Blackstone Group, for example, is a Harvard Business School grad. The head of MBA admissions at Harvard is quoted as saying that more than 27% of the senior leadership of private equity firms are graduates of Harvard Business School.

The Tuck School of Business at Dartmouth also has a well established center for private equity and entrepreneurship. Speaking to his early job-hunting experience, Tuck alumnus Ed Diffendal, Vice President at Broadview Capital, noted in an interview: “My strategy was to identify connections (either a Tuck connection or a personal connection) to specific funds and evaluate whether I would be interested in joining these funds.”

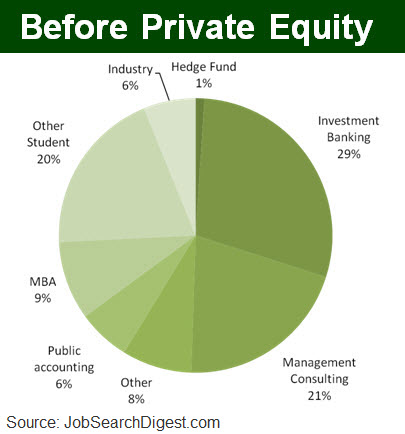

However, don’t be discouraged if you didn’t attend an Ivy League school. Having an MBA from a top tier school and experience working for an investment bank is certainly helpful but is not required for entry into a private equity firm. In fact, the Job Search Digest Private Equity Compensation Report revealed, for private equity professionals with less than 5 years of work experience, less than 10 percent started in private equity immediately after graduating from an MBA program.

While Ivy League connections can help throughout your career, ultimately, employers want to know you have the skills to do the job because they have a gap to fill.

You will need to have outstanding academic credentials and a stellar track record of work with a top investment bank, management consultancy or accounting firm — even if it’s through an internship.

For junior positions, you’ll need to demonstrate strong financial skills and the ability to quickly work your way up the learning curve. For senior roles, you’ll need a wide network of industry contacts and the ability to build rapport easily with executives.

Entry Points

Investment Banking continues to be a common entry point to a job in private equity. It provides an outstanding training ground for intense analytical and financial modeling skills needed for the business.

But private equity is changing and, along with the industry, talent are also starting to change. As private equity shifts from a financial engineering focus to an operational focus, we see an increasing focus on operational experience. Professionals are migrating into private equity after years of working at companies in a particular industry sector or as a management consultant.

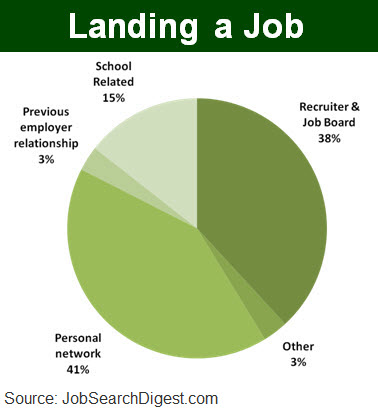

To break into the industry, no area is more important than private equity networking. You cannot rely solely on your school and alumni relationships. You’ll need to ramp up your networking to identify friends, family, colleagues – and their second and third level contacts — who may be able to connect you to people in your targeted firms.

But what about the recruiters? How important are they in the hunt for private equity jobs? Well, our research says maybe not as important as once thought.

You may want to position yourself so you come into contact with more people in the private equity industry. If you’re an investment banker, for example, you may want to get assigned to the bank’s financial sponsor team. The financial sponsor team provides capital markets expertise, contacts, strategies for operational improvement and advice to private equity firms. Being part of the sponsor team helps you broaden your network of private equity professionals and possibly uncover an opportunity to join a particular firm.

Some private equity firms use headhunters to recruit new candidates, which is even more important if your personal network is not very strong. You should develop a couple of strong relationships with the niche recruiting firms. If you are looking for private equity recruiting contacts, Job Search Digest maintains a database of firms as part of their Premium Private Equity Jobs Digest service.

Consider Making a Move

In addition to investment banking, other professions can offer a springboard into private equity. These alternate pathways include management consulting, law, accounting and operations.

Some private equity firms are known for hiring associates from management consulting firms. Some corporate lawyers who have worked extensively on leveraged buyouts have made the transition to doing deals themselves. People in lead advisory roles often have both the skills and experience to make the transition into a private equity firm.

Another route is to gain experience as a senior level executive in an industry which interests private equity firms. Private equity firms often hire C-level executives to help them run their portfolio companies more efficiently. Once you have proven yourself on the front lines, the transition is much easier.

One path we don’t recommend is trying to break in through the back office. Back office refers to those who play a supporting role in the firm, such as accounting, IT, and human resources. These positions are not as well respected by the alpha males in the front office who bring in and manage the deal flow.

Mergers and Acquisitions Experience

Another entry point is to gain M&A experience in a corporate role. For the most part, M&A transactions will be closest to the types of work you will be doing in private equity, and are therefore a good area to focus on. Private equity firms will not necessarily expect you to have closed deals at the early stages of your career. They will be looking for what you contributed to a deal, what you learned from it, and whether you were part of an unusual transaction.

In addition, you should try to polish your skills in research and due diligence, discounted cash flow (DCF), debt structuring and LBO modeling.

When the Going Gets Tough in Private Equity

Breaking into private equity has never been for the faint-hearted. Smart, talented, determined people succeed against the odds. They do it through persistence and by networking until they find a way to get their foot in the door of a private equity firm and impress the right person.

Persistence and the ability to sell will serve you well throughout your private equity career. You will need these skills to sell yourself and your fund to theCEOs of prospective portfolio companies, to potential investors to raise capital, and to partners in your firm to convince them to invest in a particular deal.

The best piece of advice we can give is to think long-term about where you want to be 5 to 10 years from now. There are a number of strategies you can take to improve your chances of eventually winding up in private equity. Consider the following:

- Places where you can work for a few years to more easily transition to private equity. Areas such as investor relations and risk management meet this criteria.

- Working for a portfolio company of a private equity firm. There’s no guarantee you’ll be hired by the firm but at least you’ll be able to expand your network of PE contacts.

- A pre-MBA analyst position at a PE firm. Junior level positions don’t guarantee moving up in the firm, however, they are a great starting point and expand your experience and contacts.

- Taking an investment banking or corporate job that involves mergers and acquisitions to build up your track record in deal making. Alternatively, get a job where you can participate in M&A from the services side (just stay away from support roles).

- Gaining operational experience or deep industry niche experience. Become a star in the right industry and private equity firms will seek you out. This also gives you the chance to pick an industry you are passionate about – which will no doubt pay off in the long run with better work and personal life balance.

Private equity has always been a challenging and rewarding career path. You need more than a stellar resume, great analytical skills and winning personality to get in.

Connections and experience is what separates the top dogs from the rest of the pack, especially in tight job markets.