Fairly well-known economist John Kenneth Galbraith once quipped: “There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” With that acknowledged, PriceWaterhouseCoopers (PwC) recently released their 2024 deals outlook, and it has some interesting takes. Here’s a review.

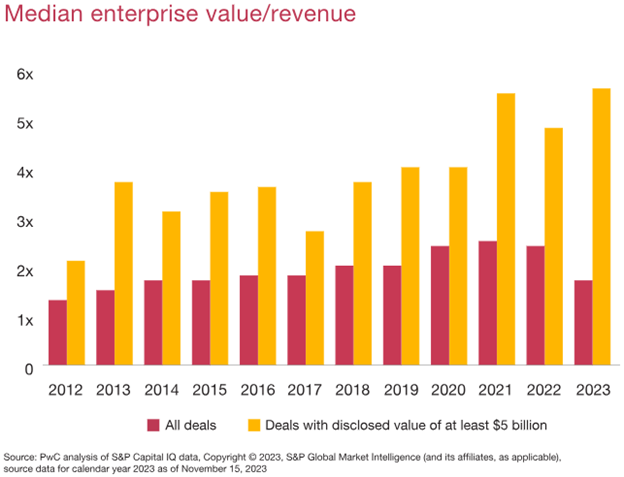

Median Enterprise Value/Revenue

The first view from PwC is the median enterprise value per dollar of revenue. Interestingly, the median enterprise value multiplier continue growing, reaching its all-time high in 2023 for deals with a value of at least $5 billion. The deal multiple reached almost an amazing 6x!

In contrast to the large deals, for deals worth less than $5 billion, the multiple declined for the second consecutive year, likely to end 2023 around 1.5x. It reached its peak in 2021 at around 2.5x. The world is changing, and in many respects, towards the big companies and deals.

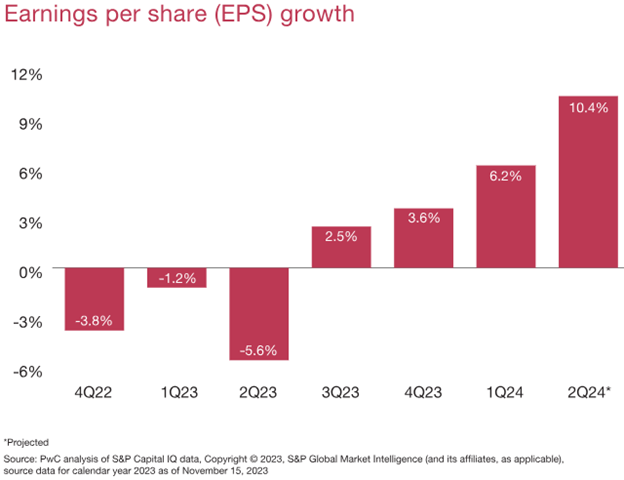

Earnings per Share Growth

The next view is earnings per share growth. Amazingly, and perhaps way too optimistic, PwC forecasts that earnings per share will grow to 10.4% earnings growth in the second quarter of 2024. That’s a healthy figure compared to the 2.5% growth in the third quarter of 2023 and the 3.6% and 6.2% growth in the fourth quarter and first quarter of 2023/2024. Certainly, some observers think 2024 could be a banner year, regardless of the potential economic headwinds.

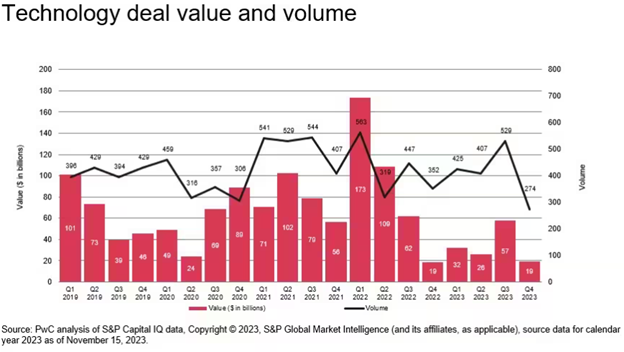

The View from the Technology Sector

With a rosy forecast as the outlook, one might ask – what’s driving the outlook? Well, one sector that may see a rebound is the tech sector. Technology deal value and volume was weak in 2022 and 2023 overall, with deal value at a very weak value of $19 billion in the fourth quarter of 2023. The $19 billion to end 2023 was consistent with the weak picture since the fourth quarter of 2022, where deal values stood at $19, $32, $36, and $57 billion. Deal value peaked in the first quarter of 2022 at a whopping $173 billion across 563 deals.

Summing Up

Overall, looking back a year ago, most forecasters thought the 2023 year would be pretty weak. The year turned out to be much better than what most expected. The 2024 outlook also seems highly uncertain, although given the 2023 results, one might be justified in being optimistic on the deal outlook. Of course, time will tell. Wishing you Happy Holidays!

{ Comments on this entry are closed }